Fundamental Analysis

The U.S. Dollar Index (DXY) has been consolidating around 106.46, while the EUR/USD pair has maintained a bullish trend, trading near 1.0485.

Key Factors Driving This Trend:

- U.S. Economic Growth Concerns: A significant drop in consumer confidence has raised fears of an economic slowdown, weakening the dollar.

- Treasury Yields: Although yields have risen, with the 10-year bond reaching 4.3289%, economic concerns have limited the dollar’s strength.

- Inflation & Monetary Policy: Inflation remains high in the U.S., but expectations of potential Fed rate cuts due to signs of slowing growth have pressured the dollar.

Potential Reasons for a Bearish Reversal in EURSD:

- Stronger U.S. Economic Data: Solid economic indicators could strengthen the dollar, putting bearish pressure on EUR/USD.

- Political Uncertainty Resolution: Advancements in fiscal or trade policies in the U.S. could improve confidence in the dollar.

- ECB Monetary Policy: If the European Central Bank adopts a more dovish stance, the euro could weaken against the dollar.

In summary, while EUR/USD has shown recent bullish momentum due to economic concerns in the U.S., shifts in economic data or monetary policies could trigger a trend reversal.

Technical Analysis

U.S. Dollar Index (DXY), H4

- Supply Zones (Sell): 106.52 // 106.92 // 107.50

- Demand Zones (Buy): 106.00 // 105.75 // 105.40

The DXY is our primary reference for USD behaviour, and we see a consolidation within the broader bearish trend after an initial weak breakout of the last intraday key resistance at 106.68. A confirmation with a second higher high would signal a potential bullish reversal, targeting nearby supply zones for liquidity.

However, if the price struggles against the 106.52 supply zone and drops below the 106.00 support, further downside could extend toward December lows in the short term.

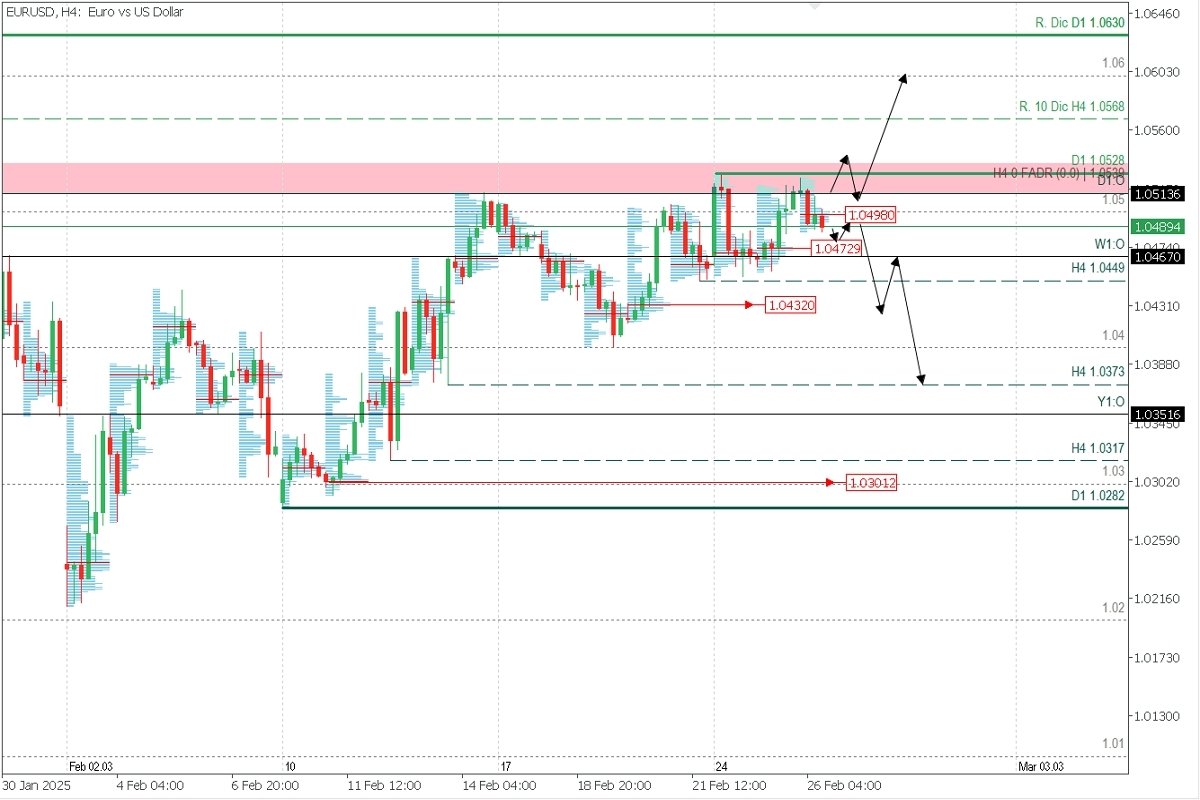

EURUSD, H4

- Supply Zones (Sell): 1.0528 // 1.0568 // 1.0600

- Demand Zones (Buy): 1.0473 // 1.0449 // 1.0400 // 1.0373

Mirroring the DXY, we also observe consolidation and weakening bullish momentum in EUR/USD as it trades around a December–January supply zone (pink band) and forms a potential bearish head and shoulders reversal pattern.

A deeper bearish move could unfold if the price remains below the macro supply zone at 1.0528 and decisively breaks the local demand zone at 1.0473. This could lead to a breakdown of the last validated intraday support at 1.0449, targeting the 1.0432 supply zone. A confirmed lower low at 1.0400 and 1.0373 would validate the bearish reversal.

However, a confirmed bullish breakout above the macro supply zone and daily resistance at 1.0528 would invalidate the bearish scenario, signaling USD weakness with upside targets at 1.0568 and 1.0600, key December levels.

Technical Summary

- Bearish Scenario: Sell below 1.0472 with TPs at 1.0449, 1.0432, 1.0400, and 1.0373 in extension.

- Bullish Scenario: Buy if the price decisively breaks (candle body) above 1.0528, targeting 1.0568, 1.0600, and 1.0630 in the coming days.

Always wait for the formation and confirmation of an Exhaustion/Reversal Pattern (ERP) on M5, like the ones we teach here: https://t.me/spanishfbs/2258, before entering trades at the key zones indicated.

Discovered POC:

- POC = Point of Control: The level or zone where the highest volume concentration occurred. If the price previously moved down from it, it acts as a resistance zone. Conversely, if the price previously moved up, it acts as a support zone.