Fundamental Analysis: UK Inflation and Monetary Policy Expectations

Key Takeaways:

- UK inflation miss (2.8% YoY) pressures GBP, but sticky services inflation (5%) tempers BoE rate cut bets.

- Fiscal policy in focus: UK Spring Statement's spending cuts may limit growth, keeping GBP vulnerable.

- USD resilience persists despite tariff risks, with PCE data as next catalyst.

- Critical technical levels: 1.2850 (support) and 1.2950 (resistance). Breakouts will dictate short-term direction.

- Risk warning: Monetary policy divergence (BoE vs. Fed) and geopolitics fuel volatility.

The British Pound (GBP) faces bearish pressure this Wednesday following weaker-than-expected UK inflation data. February's annual Consumer Price Index (CPI) came in at 2.8%, below the 2.9% forecast and January's 3.0% reading. Core inflation (excluding volatile items) also eased to 3.5%, reinforcing expectations of potential Bank of England (BoE) rate cuts in coming months. However, services inflation—a key BoE metric—remained sticky at 5%, potentially delaying aggressive monetary easing.

Key Short-Term Drivers

Market focus now shifts to UK Chancellor Rachel Reeves' Spring Statement, expected to announce fiscal measures including welfare cuts and a £2.2 billion defense spending boost. Moderate fiscal tightening could cap economic growth and keep GBP subdued. Meanwhile, the US Dollar (USD) shows resilience despite uncertainty over potential Trump tariffs (April 2 deadline), adding volatility to the pair.

USD Outlook

Friday's US Core PCE data (Fed's preferred inflation gauge) will be critical. A persistent print (forecast: 2.7% YoY) may strengthen the USD further, while a downside surprise could revive risk appetite and temporarily relieve GBP pressure.

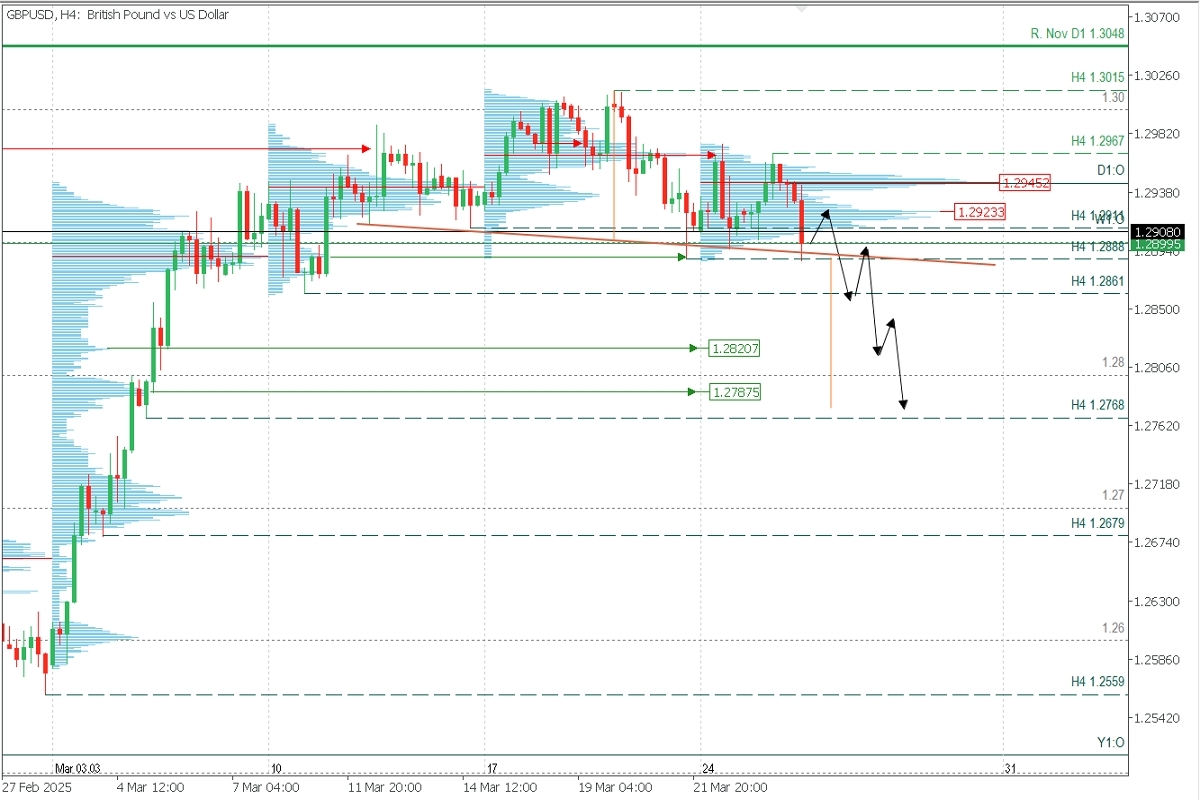

Technical Analysis | GBPUSD, H4

Supply Zone (Sell): 1.2945 || Demand Zones (Buy): 1.2820 / 1.2787

Price opened the session with a -0.40% decline following disappointing UK February CPI data. This activated a head-and-shoulders reversal pattern, with the descending neckline indicating increasing bearish pressure.

The bullish technical structure is challenged by two consecutive (though weak) breakdowns below the key H4 support at 1.2911. This latest low establishes 1.2967 as the last validated H4 resistance, which now serves as our reference level for maintaining a bearish bias unless decisively broken.

In this context, we anticipate further downside after a potential pullback toward 1.2927-1.2930, where fresh selling pressure could emerge. Targets align with high-volume demand zones at 1.2820 and 1.2787, which also match the measured move projection of the reversal pattern.

Trading Scenarios:

- Bearish: Wait for buyers to push the price to 1.2927, then sell below it, targeting 1.2861, 1.2820, 1.2800, and 1.2787.

- Bullish: Only above 1.2787, targeting 1.2860.

Invalidation Conditions: The reversal scenario is invalid if the price decisively breaks above the 1.2945 POC (Point of Control) and the 1.2967 resistance.

Critical Notes:

Reversal/Exhaustion Pattern (PAR): Always wait for M5 confirmation (e.g., pin bars or engulfing patterns) before entering trades at key levels.

POC Significance: The Point of Control marks the highest volume concentration. If the price previously fell from this zone, it acts as resistance; if it rallied, it becomes support.

This technical outlook remains valid unless fundamental catalysts (e.g., US PCE data) override price action.