Wall Street braces for Tuesday’s June CPI release, with consensus calling for a 0.3% monthly rise that could lift annual inflation to 3.1–3.3%. Core CPI is seen advancing to around 3.0–3.3% year-on-year, setting a fresh high in underlying price pressure.

Tariffs loom large in this report: economists increasingly highlight import levies as drivers of higher goods prices, while sticky core services inflation remains the Fed’s chief concern. Though markets still see a roughly 90% chance the Fed holds rates steady at 4.25–4.50% next week, futures imply modest cuts by September and up to 50 bps by year-end.

A hotter-than-expected print risks delaying that timeline, likely boosting the US dollar, lifting Treasury yields, and weighing on major pairs like EURUSD and GBPUSD. Conversely, softer inflation could revive easing hopes and weaken the greenback.

For traders, the focus narrows to core services strength and any tariff-driven commentary that might reset rate-cut bets—and test the Fed’s resolve.

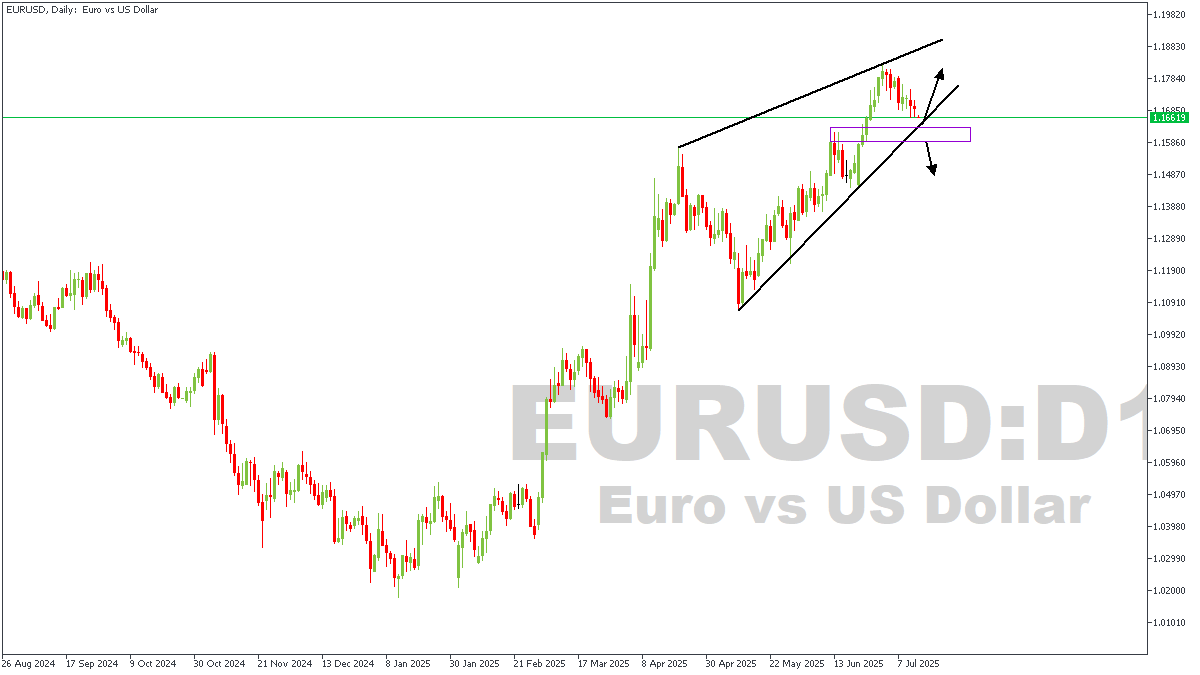

EURUSD D1 Timeframe

The price action on the daily timeframe chart of EURUSD is currently wedged between two trendlines, albeit with more bounces off the trendline support. Usually, the confluence of a breaker block and the trendline support serves as a bullish confirmation but in this circumstance, there is a chance the trendline gets broken since price has bounced off it several times already. My sentiment on EURUSD remains unclear until there is a clear confirmation of either a bounce or a breakout.

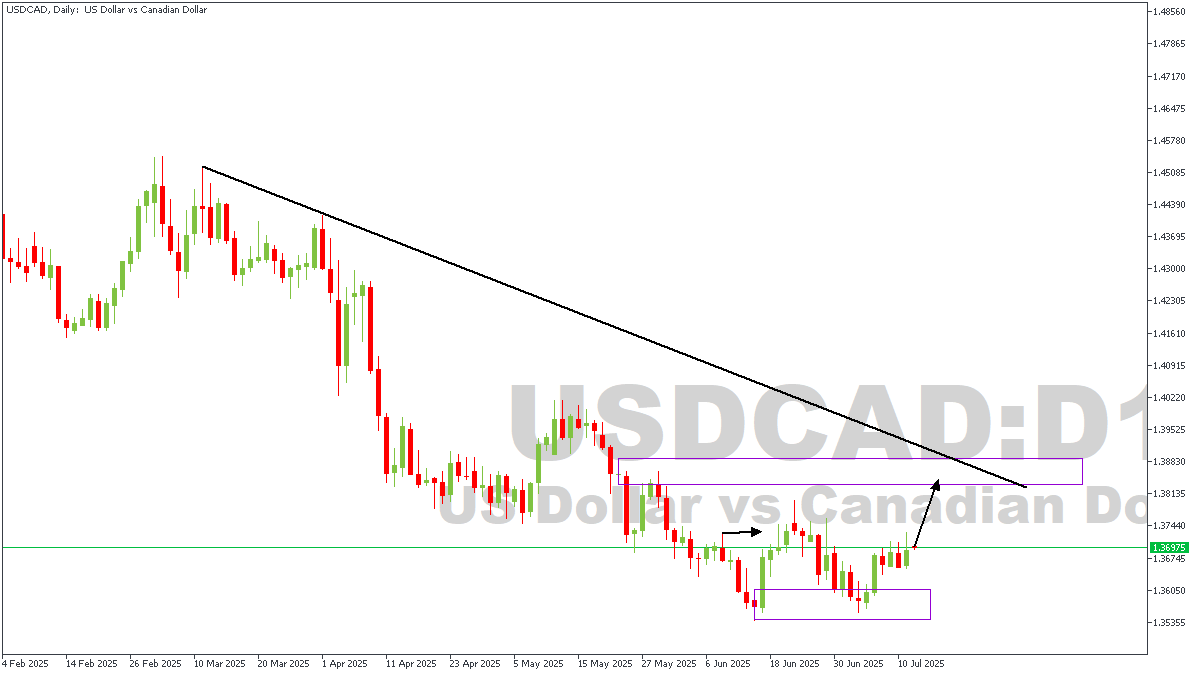

USDCAD D1 Timeframe

USDCAD began a steady climb a while ago, starting with a bullish rejection from the demand zone at the base. The ongoing bullish impulse is expected to capture liquidity from the recent high, hence my bullish sentiment.

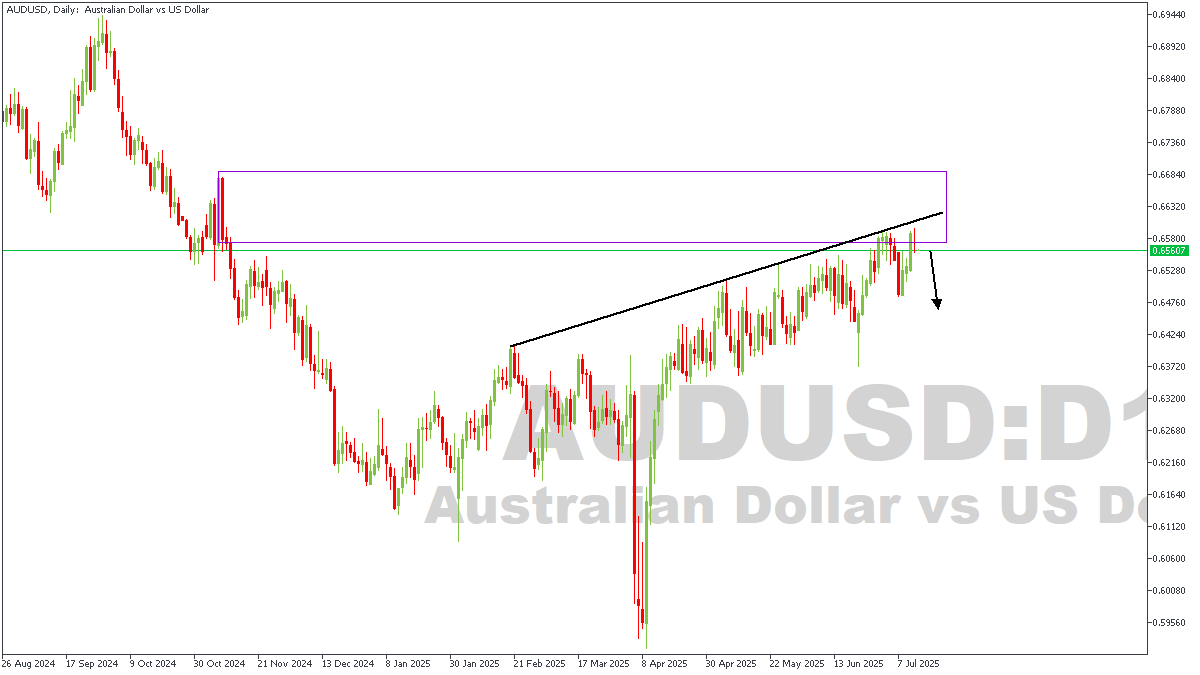

AUDUSD D1 Timeframe

On the daily timeframe chart of AUDUSD, we see a confluence of the trendline resistance and a critical supply region, which is so-called since it overlaps a pivot on the weekly timeframe. The rejection from this confluence is expected to sweep liquidity from the recent lows, at least before the price gets a chance at a reversal. My sentiment here remains bearish until price overshoots the supply zone.

Direction: Bearish

Target- 0.65422

Invalidation- 0.66006

CONCLUSION

You can access more trade ideas and prompt market updates on the Telegram channel.