Fundamental Analysis

Netflix faces a key week as it prepares to report quarterly earnings in a market environment where most tech giants face significant corrections. Yet, Netflix stands out with a 7.9% year-to-date gain in 2024.

While Apple, Amazon, Meta, and other “Magnificent 7” names are down 22%, Netflix is emerging as a haven. What explains this resilience?

- First, its business model is fully digital. Unlike Apple or Tesla, Netflix is not dependent on supply chains or physical manufacturing. This makes it immune to immediate impacts from geopolitical conflict, trade wars, or global logistics disruptions.

Second, its subscriber base remains loyal even during recessions. In tough times, people cut back on travel, dining, or shopping—but tend to keep their streaming subscriptions. Netflix's cheapest plan, at $6.99 with ads, is seen as an “affordable luxury.”

Third, its advertising model is growing fast. Still in its early stages, this revenue stream is starting to add value and diversify its cash flow, adding to its stability in a volatile market.

Technical outlook: bullish pressure with defined targets

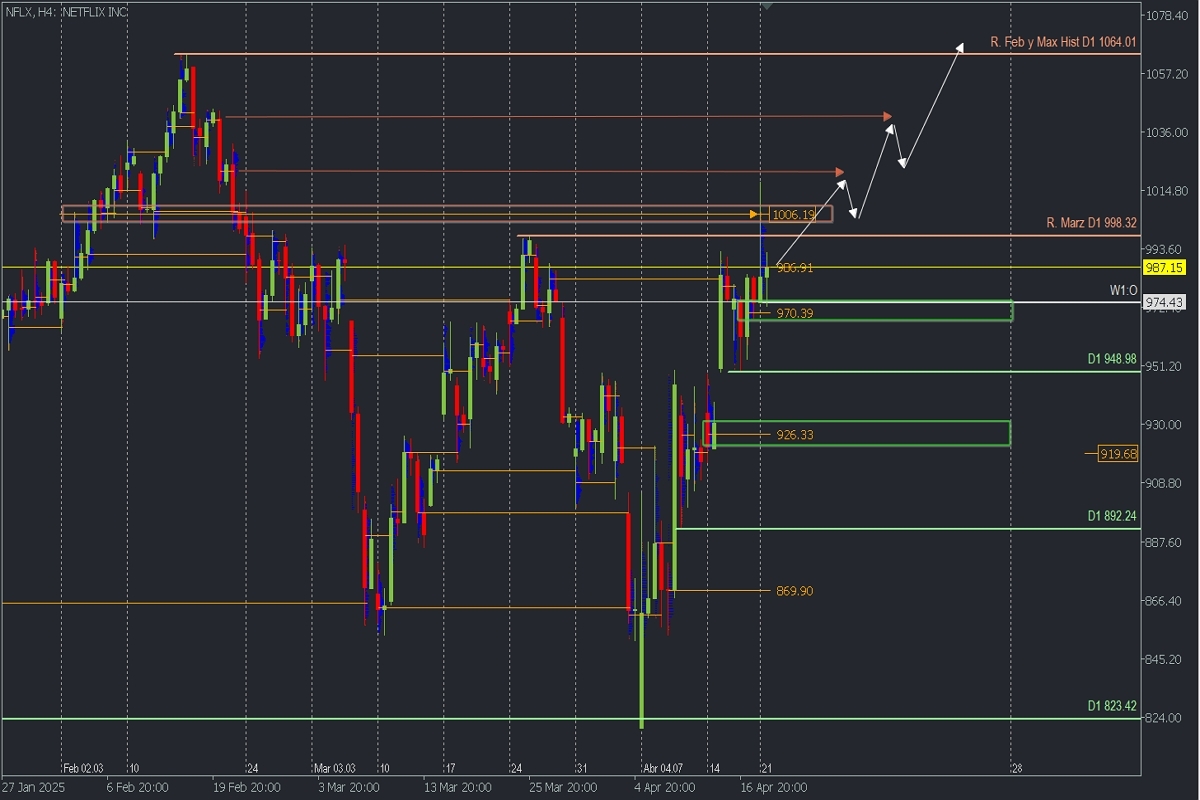

NETFLIX | H4

- Bid Zone (Sell): 1006.19/ 1022 / 1040

- Ask Zone (Buy): 970.39 /926.33 / 869.90.

- Key Resistance: Historic Max at 1064.01

- Key Support: 892.24.

Netflix maintains a strong bullish structure. Price is currently above the key weekly support at 948.98 and the previous week’s POC at 970.39. This setup supports the potential for a new upward move. If earnings are strong, the price could move toward the supply zones at 1022 and 1040. A decisive breakout above these levels would make the historical high of 1064.01 the next major target.

The bearish scenario would only be activated if the price closes below 970.39. In that case, a drop toward 948.97—or lower—could follow if results disappoint or future outlook weakens.

Conclusion

Netflix stands out as one of the few tech companies with solid fundamentals, a favourable technical setup, and a resilient model amid high volatility. For retail traders, it offers a clear opportunity to find performance while the broader market stumbles.