The Nikkei has eased slightly—down 0.5–0.6% from its recent one-year highs—on seasonal profit-taking. Immediate support lies near 40,800–41,000, while resistance sits around 42,000. Longer term, analysts project potential upside toward ¥45,500 by 2026, provided earnings momentum and trade clarity persist.

Fundamental Factors Affecting the Nikkei

- Trade Deal Boost: The US–Japan trade agreement, cutting auto tariffs to 15%, has buoyed sentiment, especially among automakers like Mazda and Toyota, driving the Nikkei higher.

- Valuation Support: The index trades at a forward P/E of 18×, cheaper than its US peers. Its structural backing comes from corporate reforms and earnings growth.

- BoJ Policy Nuance: While several board members have grown hawkish due to inflation and fiscal pressures, Governor Ueda continues to stress caution. This divergence keeps expectations for significant tightening muted in the near term.

1. Trade optimism & valuation support

The recent US–Japan trade deal—with auto tariffs cut to 15%—lifted investor sentiment, sending the Nikkei toward a one-year high as automakers like Mazda and Toyota rallied sharply.

The index trades at a forward P/E of around 18×, notably lower than its US peers. Earnings growth and corporate reforms offer solid structural support.

2. BoJ caution and monetary divergence

While the Bank of Japan’s board grows hawkish due to inflation and fiscal concerns, Governor Ueda maintains a cautious stance, nudging markets toward a policy delay amid uncertain export trends.

3. Technical & sentiment signals

As seasonal factors and profit-taking emerge, Nikkei has pulled back about 0.5–0.6% from recent highs. Analysts expect a possible end-2025 level around ¥42,000, with upside toward ¥45,500 in 2026 if trade clarity and earnings momentum persist.

JP225 H4 Timeframe

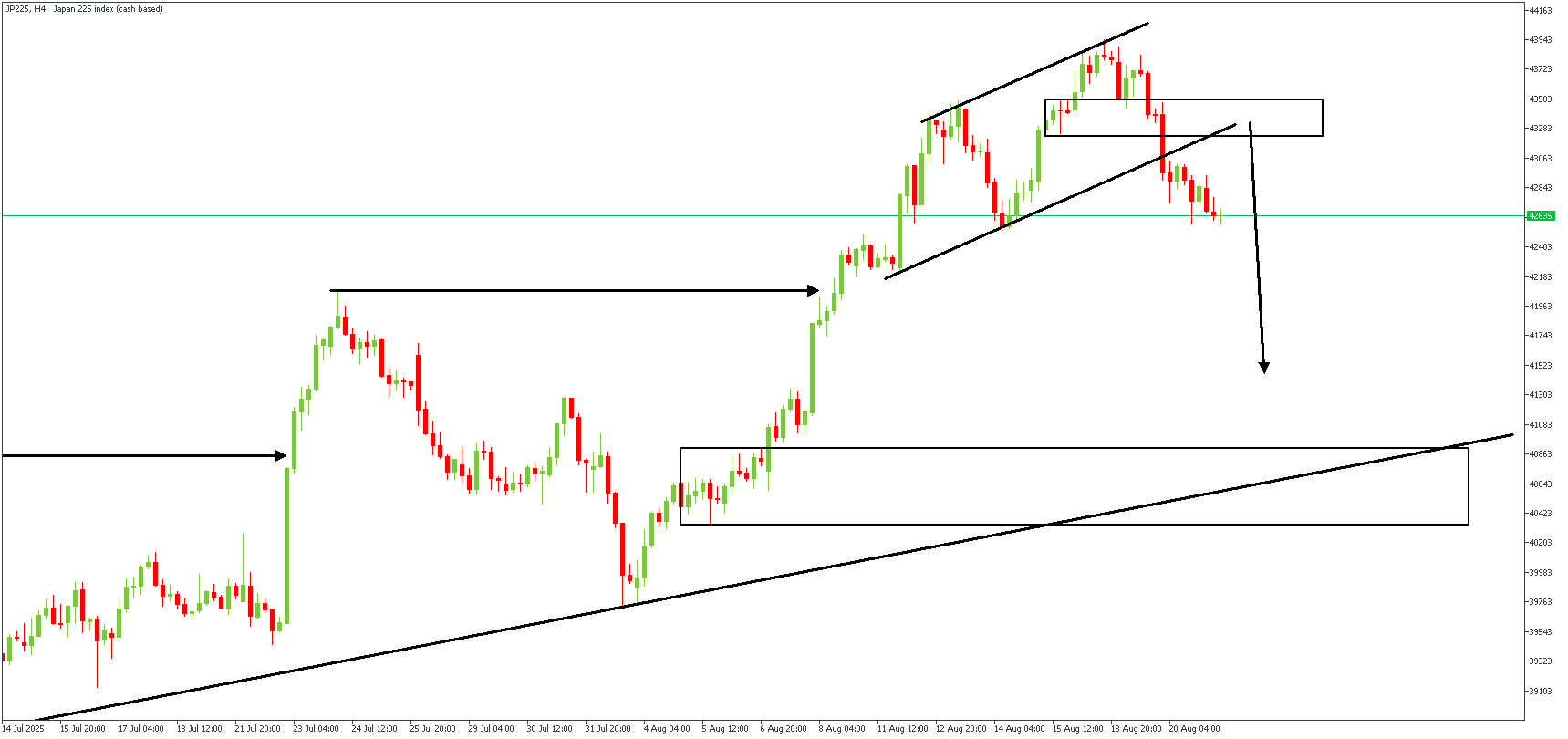

On this JP225 H4 chart:

Price recently broke down from a rising channel after failing to sustain momentum above the 43,700 zone. Sellers pushed aggressively, driving the index below the channel support and the retest block around 43,500–43,200.

Currently, JP225 is consolidating near 42,600, with bearish pressure dominating. The black arrow projection suggests a continuation lower toward the next key demand zone around 40,800–40,400, which aligns with both horizontal structure and the ascending trendline from July.

Key technical highlights:

- Clear bearish channel breakout signaling momentum shift.

- The retest block at 43,500–43,200 rejected price, confirming supply dominance.

- A strong bearish impulsive leg suggests that sellers remain in control.

- Next significant support rests at 40,800–40,400, overlapping with trendline confluence.

Direction: Bearish

Target- 41372

Invalidation- 43902

CONCLUSION

You can access more trade ideas and prompt market updates on the Telegram channel.