The Reserve Bank of Australia (RBA) is widely expected to deliver a 25-basis-point rate cut at its July 8 meeting, bringing the cash rate from 3.85% to 3.60%. According to Reuters, Forbes, ABC, AFR, and the Guardian surveys, the move has been fully priced in by the markets, with nearly 90% probability baked in. The big four Australian banks are also in consensus, seeing this as the first step in a broader easing cycle.

Futures markets and economic analysts project as many as five cuts through 2025, pointing to a terminal rate between 3.10% and 2.85% by early 2026. This dovish shift is primarily supported by data showing trimmed-mean inflation slowing to 2.4% year-on-year in May—the lowest reading since late 2021.

The RBA’s policy rationale hinges on moderating domestic consumption, subdued wage growth, and increased global uncertainties. In its May statement, the central bank flagged that inflation risks remain but suggested conditions may warrant gradual easing. Nonetheless, Westpac and others caution that forward guidance will remain cautious despite the expected rate cut, highlighting labor market tightness and geopolitical factors.

AUD Market Reaction Scenarios:

- Expected cut + dovish tone: The AUD may weaken further, especially if the RBA hints at additional cuts in August or November.

- Expected cut + cautious tone: With the cut priced in, the AUD could stabilize or rebound slightly if the RBA avoids strong signals of further easing.

- Surprise hold: An unexpected decision to keep the rate at 3.85% would likely trigger a sharp AUD rally.

Bond markets are already aligning with the dovish outlook, with yields on Australian government bonds easing. Equity markets may benefit modestly from rate relief, particularly housing-related sectors, though rising home prices could renew affordability concerns. Mortgage holders are expected to save between $900 and $1,200 annually on a standard $500,000 loan.

Key Details to Watch on July 8:

- Rate decision: A move to 3.60% is entirely expected.

- Statement language: Traders will scrutinize any language around future cuts, inflation concerns, or labor market slack.

- Governor’s remarks: Even offhand comments post-decision could sway AUD sentiment.

Bottom Line: A rate cut is almost inevitable—but for AUD traders, the tone of the RBA’s statement will be the actual market mover. Dovish signals may send AUD lower, while a cautious or neutral stance could trigger a relief bounce.

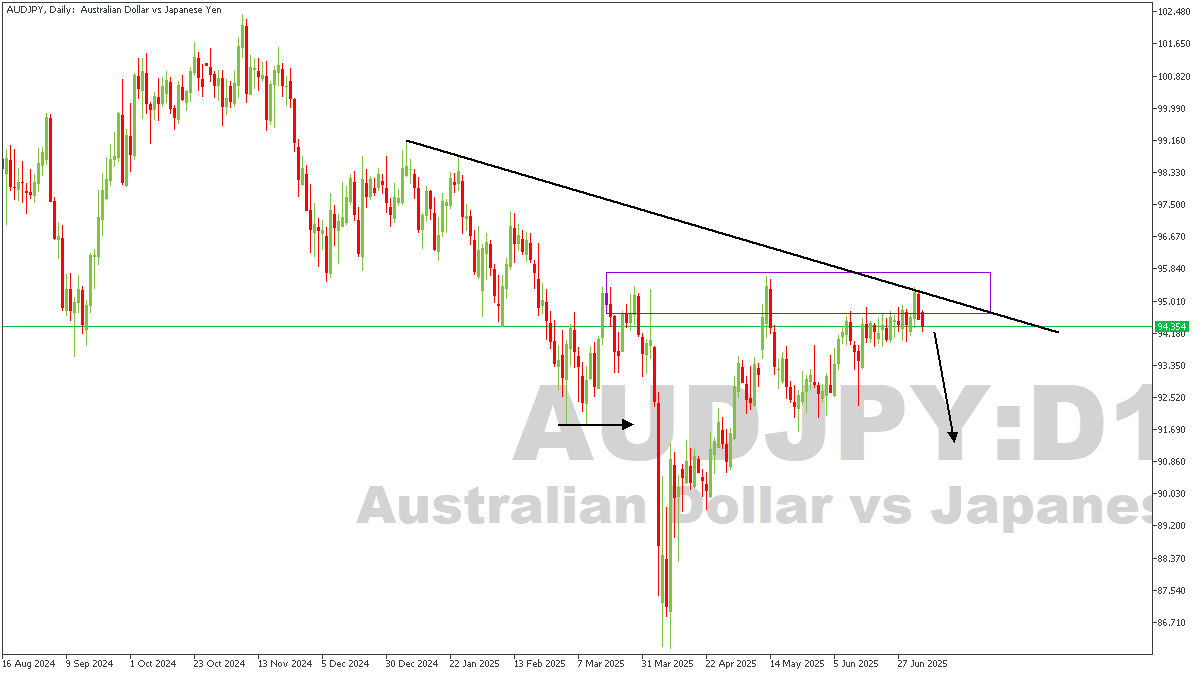

AUDJPY D1 Timeframe

The AUDJPY daily timeframe chart shows a bearish setup. The black trendline above the price acts as resistance, showing that each time price tries to rise, it gets pushed back down. The purple box highlights a supply zone—an area where sellers have stepped in before—and price is currently reacting from that zone again. Based on the confluence of the trendline resistance, supply zone, and market structure, the conclusion is in favor of a bearish sentiment.

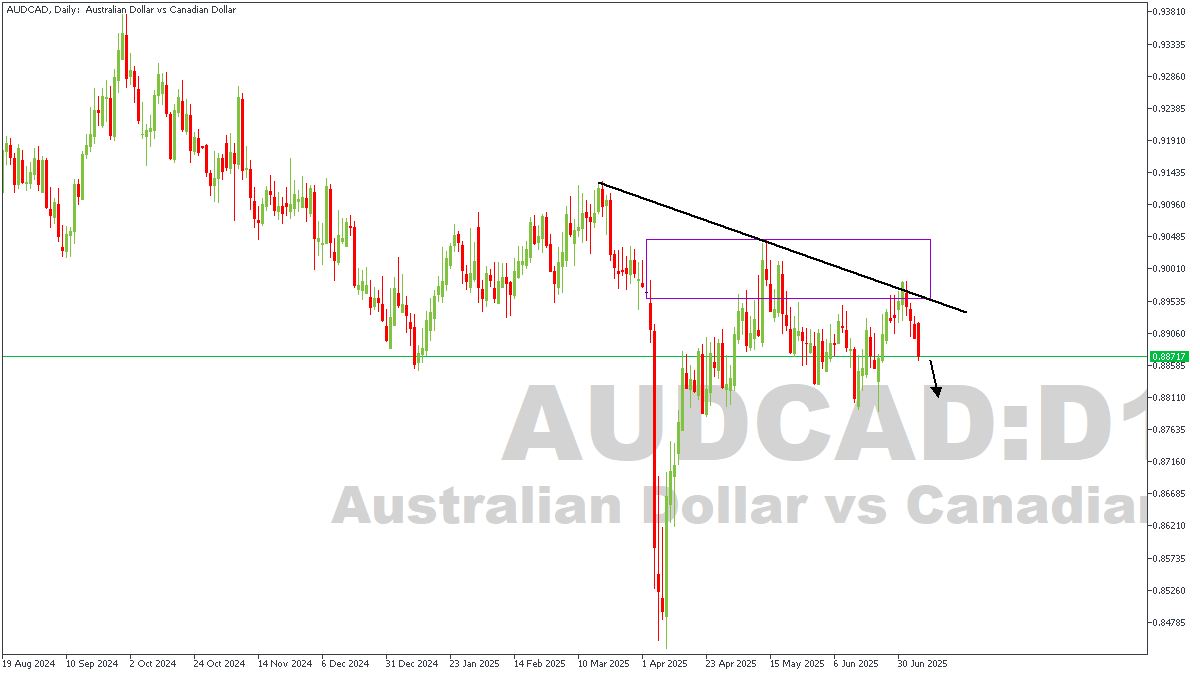

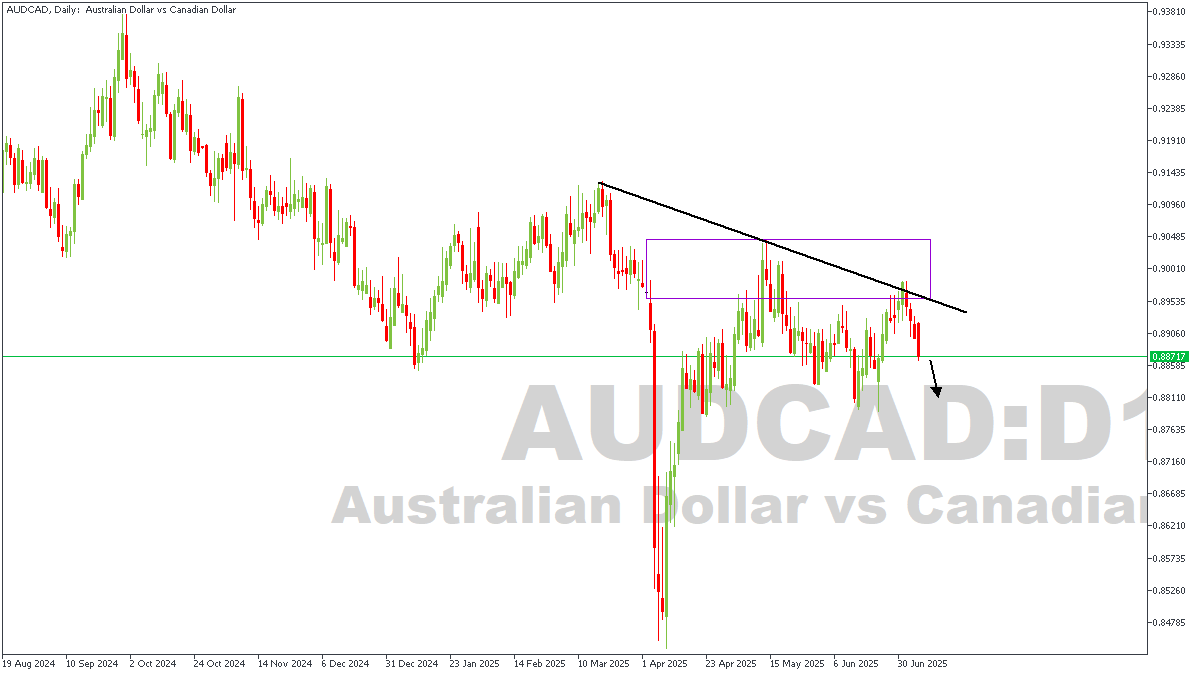

AUDCAD – D1 Timeframe

AUDCAD presents a similar outlook on the daily timeframe chart. Here, we see price being rejected from the confluence region of the resistance trendline and the supply zone. Since price has not yet recaptured a former liquidity level, I hope to see price slide much lower.

AUDUSD – D1 Timeframe

Currently, the price action on the daily timeframe chart of AUDUSD shows price bouncing off a resistance trendline that cuts right through the supply zone. Understanding that price swept above the inducement high to capture liquidity before reacting off the supply zone increases my confidence in the likelihood of a bearish outcome.

Direction: Bearish

Target- 0.64244

Invalidation- 0.66310

CONCLUSION

You can access more trade ideas and prompt market updates on the Telegram channel.