Fundamental Analysis

Silver (XAGUSD) is rallying on two key forces:

- Strong industrial demand from solar panels, EVs, and technology.

- Growing safe-haven demand in an uncertain global environment.

The Federal Reserve has shifted the narrative. Powell confirmed no cut in November and only one in December. That means higher rates for longer, which could limit the rally’s upside.

Still, investment flows remain strong. Silver-backed ETFs are attracting significant inflows, especially in Asia, showing institutional appetite.

COT data adds a twist: producers are heavily short, while funds are increasing longs. This imbalance could spark a short squeeze if speculative buying continues.

In short, silver’s rise is supported by real demand and financial flows. But its future depends on U.S. data. Strong economic numbers could trigger a correction, while weak data may push prices higher again.

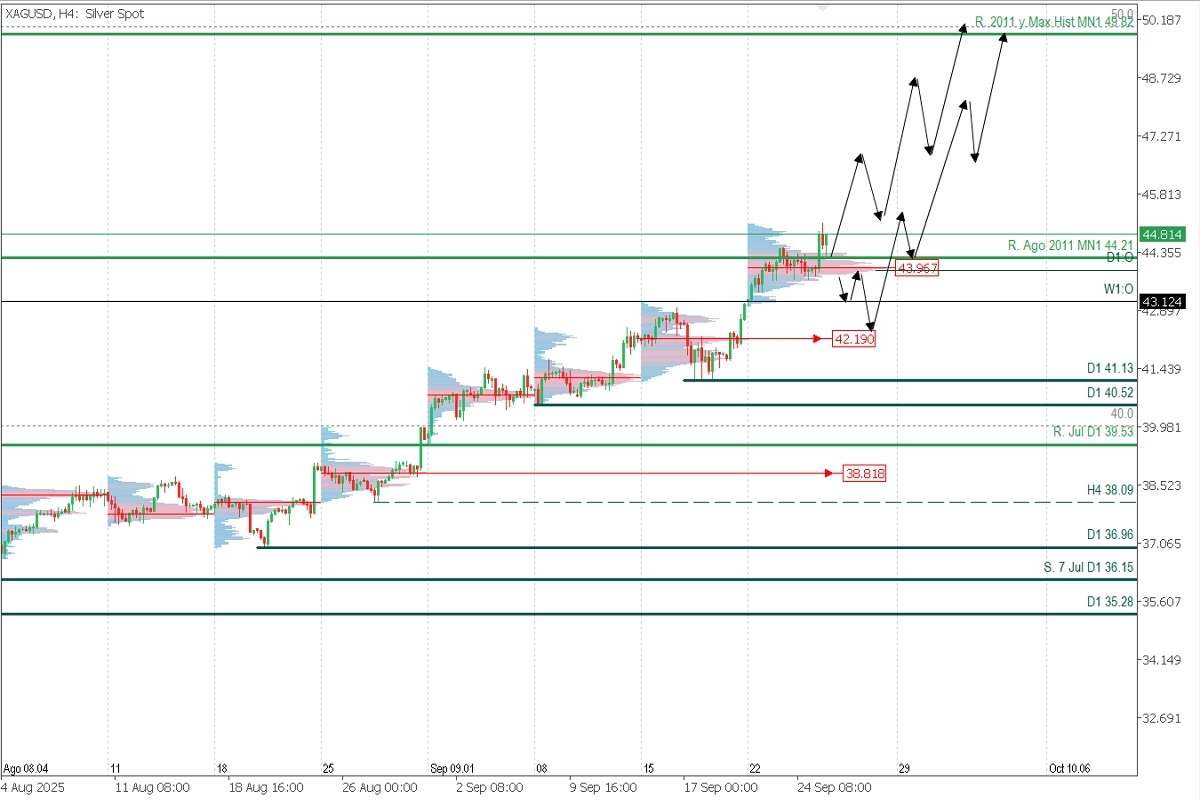

Technical Analysis – XAGUSD (H4)

- Supply zones (sell): $45.00 | $46.00

- Demand zones (buy): $43.96 | $42.19

Silver trades above the weekly POC at $43.96 and demand from $42.19, giving bulls solid ground.

- Bullish scenario: Buys above $44.20 with targets at $46.00 → $47.00 → $48.00 → $49.00 → $50.00 (breaking the 2011 ATH at $49.82).

- Bearish corrective scenario: A decisive break below $43.96 could push prices to $43.12 or $42.19 before bulls attempt another rally.