The U.S. June jobs report (Non-Farm Payrolls, to be released July 3 due to the July 4 holiday) will be closely watched as a barometer of economic health. Recent data suggest a cooling economy under trade-related headwinds: Q1 GDP was revised to –0.5% annualized, while ISM surveys show manufacturing and services contracting (PMIs ~48.5 and 49.9 for May). Inflation has been moderating but remains above target (headline CPI ~2.4% y/y in May, core ~2.8%). Tariff-related price pressures and slowing consumer spending are key concerns. Against this backdrop, the labor market has softened but not collapsed: job gains have trended below 150K recently, and wages are rising moderately (average hourly earnings ~+0.3% m/m, ~3.9% y/y in May).

Labor Market Trends and Forecasts. Payroll growth averaged ~149K in 2024 but slowed to 139K in May, with significant downward revisions (March-April cut by 95K). RSM's Joe Brusuelas expects only 100K jobs added in June (down from 139K in May) with the unemployment rate rising to ~4.3%. By contrast, consensus forecasts (e.g., Reuters surveys) hover around 125–130K jobs and a steady 4.2% unemployment rate. Wages are expected to moderate (e.g. ~+0.3% m/m, 3.9% y/y). These forecasts reflect a labor market that is still tight by historical standards, but is gradually cooling as tariff uncertainty and slower global demand dampen hiring. (U.S. job openings and quits have also softened.)

Economic Context: Payroll data will be interpreted with mixed growth signals. Manufacturing and service PMIs fell below expansionary levels, and recent ISM comments highlight trade-policy uncertainty. Consumer spending has decelerated and was a drag in Q1. Inflation has slowed (May CPI rose just 0.1% m/m), but economists and Fed officials warn tariffs will push prices higher in the coming months. Importantly, wage growth remains a key inflation driver: some analysts note that any eventual tariff‑driven inflation surge may be blunted if the jobs market softens. In short, the economy is at risk of "stagflation-lite" – modest growth with inflationary pressures.

Policy Implications: The Fed paused in June (maintaining 4.25–4.50%), and its latest forecasts still call for two rate cuts by end‑2025. However, Chair Powell cautioned that tariffs create "meaningful" inflation ahead of time, and Fed officials remain data‑dependent. A hot jobs report (much stronger than expected) – implying still-tight labor conditions – would reinforce the Fed's recent stance to hold rates longer, as it suggests inflation risks remain. For example, Reuters notes "solid wage growth…should allow the Federal Reserve to delay resuming its interest rate cuts". In that scenario, markets would likely push back the timeline for easing. An in-line outcome (jobs near forecasts, unemployment stable) would be seen as status quo: the Fed would remain on hold while monitoring tariffs and inflation, with possible cuts still penciled in for the fall.

By contrast, a weak report (payrolls well below forecasts and unemployment rising) would heighten concerns about a cooling economy. RSM warns that monthly job gains falling below 100K would likely "elicit further calls for a rate cut". In practice, disappointing job growth could prompt economists to bring forward Fed easing bets (e.g., autumn cuts) since it would signal slower demand and likely slow wage inflation. Nonetheless, even a soft report might not force an immediate cut this summer, given the Fed's emphasis on getting clear evidence of easing inflation. RSM notes current data support the Fed's "status quo" policy stance, with no near‑term rate reduction until trade uncertainties and inflation are better understood.

In sum, the June NFP report will critically check the labor market amid trade shocks. Strong job growth and wage gains would bolster the case for rate-hold patience, while a surprise softening would strengthen arguments for cutting rates sooner (albeit tempered by tariff‑driven inflation risks). Policymakers will parse these jobs metrics alongside inflation, ISM, and GDP trends to gauge whether the economy is slowing fast enough to ease monetary policy, or still robust enough to warrant waiting.

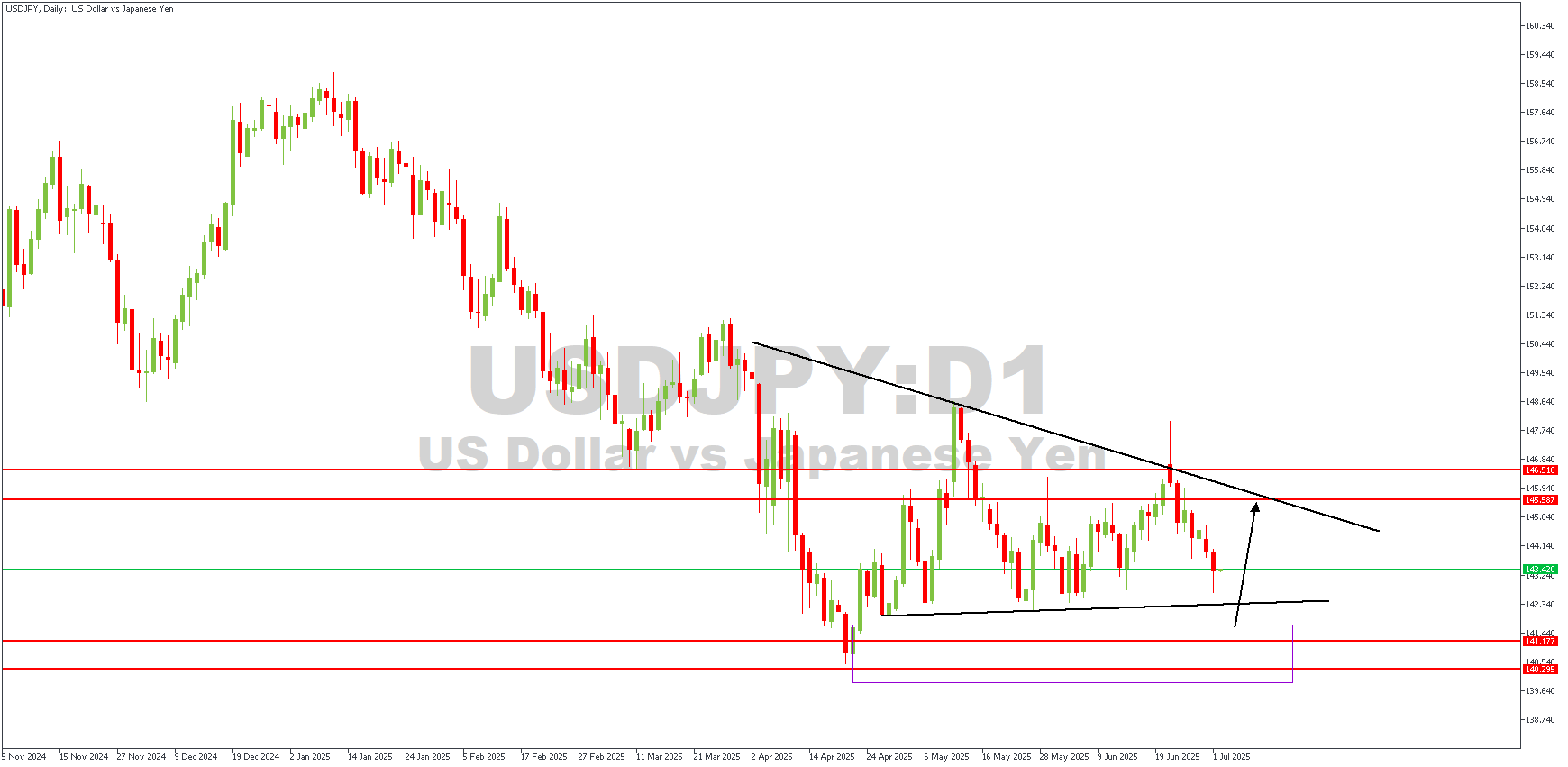

USDJPY D1 Timeframe

On this USDJPY daily timeframe chart, price is moving within a consolidation range below a descending trendline. The plan is to see if price retests the demand zone overlapping the support area (highlighted in purple) and holds. If it does, I expect a bounce back toward the trendline resistance around 145–146. I'll look to buy near the support zone and target the trendline as my first take‑profit level. This trade idea relies on the support zone holding firm to trigger this bullish move.

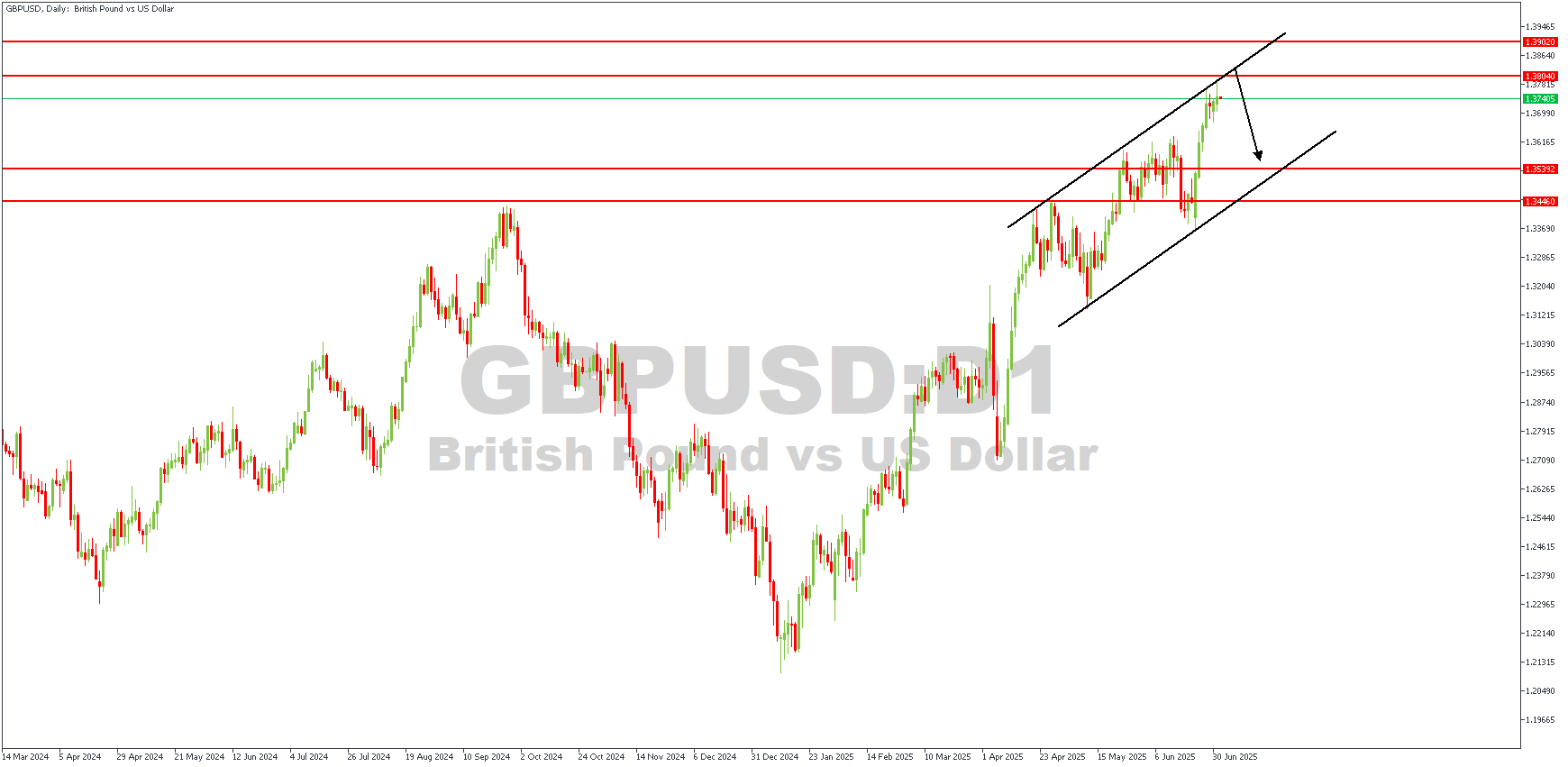

GBPUSD – D1 Timeframe

In the case of the GBPUSD daily timeframe chart, we see price trading inside an upward channel, approaching a significant resistance zone near 1.3900. I intend to wait for price to test the top of the channel and resistance area. If price triggers a bearish structural confirmation there, I'll look to sell, targeting a move back toward the channel's lower boundary. This setup is based on the idea that resistance and channel structure might cause a pullback. Confirming a bearish rejection at the top of the channel is the basis of confirmation for the bearish entry.

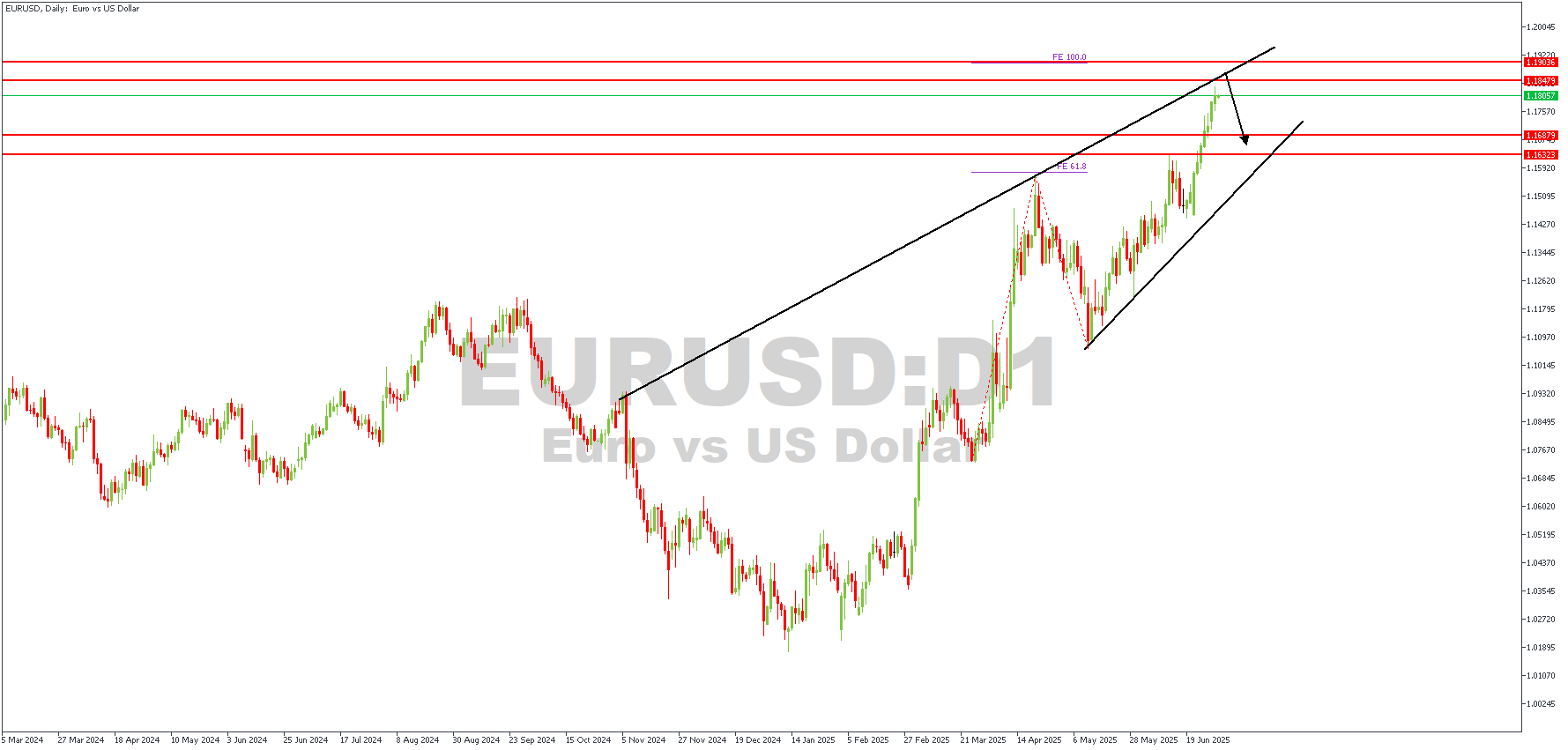

EURUSD – D1 Timeframe

On the daily timeframe chart of EURUSD, price is climbing within a rising wedge and approaching strong resistance near 1.1900–1.1930 (also matching the FE 100% extension). The plan here is to wait for price to test this resistance and the wedge top. If I get bearish confirmation, I'd look to sell, targeting a move back to the lower wedge boundary. Do note that the bearish sentiment would be invalidated if the price breaks above the highlighted resistance without rejection.

Direction: Bearish

Target- 1.17272

Invalidation- 1.19155

CONCLUSION

You can access more trade ideas and prompt market updates on the Telegram channel.