Gold prices went up by 0.30% on Tuesday as US Treasury yields dropped and the US dollar weakened, with traders waiting for important US inflation data. This data, along with the first presidential debate between Kamala Harris and Donald Trump, may influence the market's mood. Gold (XAUUSD) is currently trading at $2,514, recovering from a low of $2,500. The chances of a Federal Reserve interest rate cut are high, with a 67% likelihood of a 25 basis point reduction and a 33% chance for a 50 basis point cut. Recent US job data showed fewer new jobs than expected, but the unemployment rate fell slightly, offering some relief to the Fed.

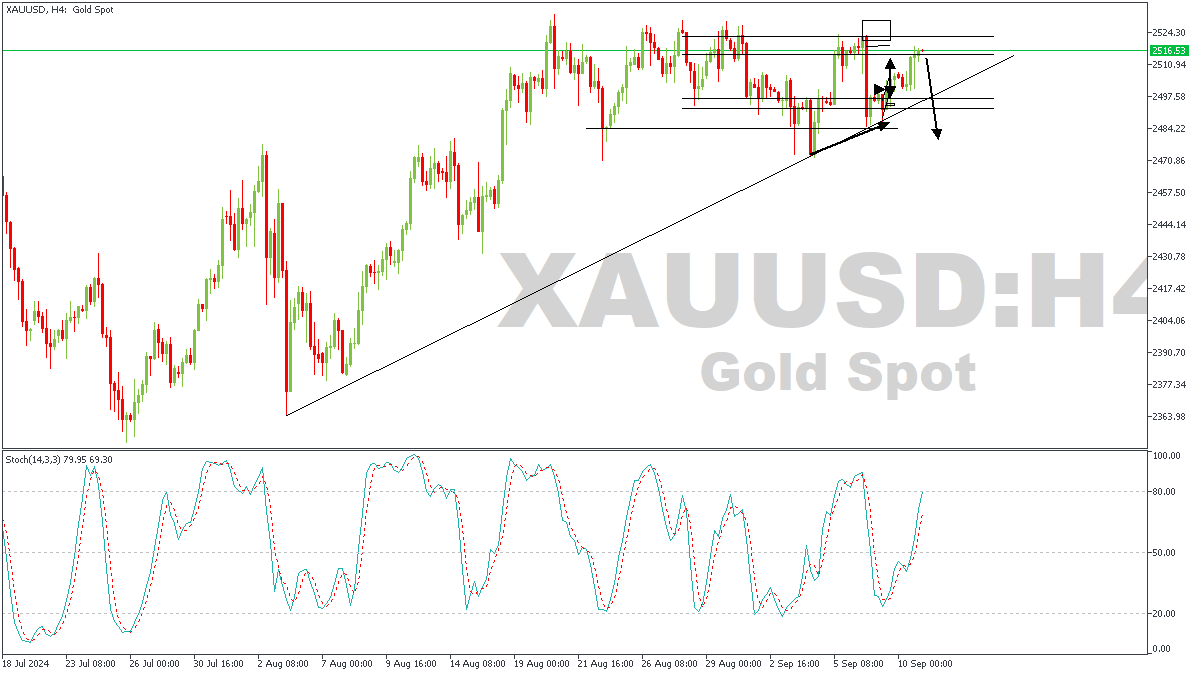

XAUUSD – H4 Timeframe

Gold did a bounce from the trendline support earlier, due to the confluence of the daily timeframe pivot and the hidden divergence on the stochastic indicator. However, the current price action is now resting within the region of another daily timeframe pivot, with the likelihood of a reversal soon. I expect this to provide an opportunity for bears to infiltrate the markets, albeit, my secondary choice of an entry would be from the break-and-retest of the trendline support.

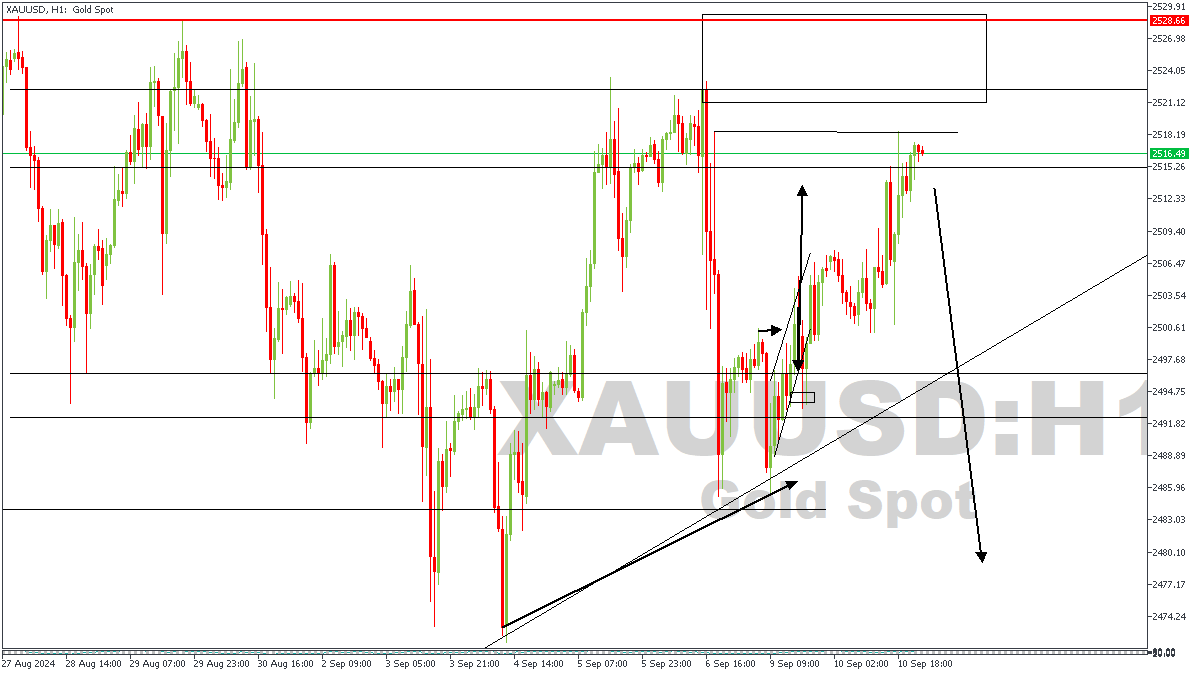

XAUUSD – H1 Timeframe

As for the price action on the 1-hour timeframe, price seems to be plotting a SBR pattern, which I hope to confirm after the rejection from the supply zone above inducement. Altogether, my sentiment remains bearish.

Analyst’s Expectations:

Direction: Bearish

Target: $2,495.75

Invalidation: $2,530.15

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.