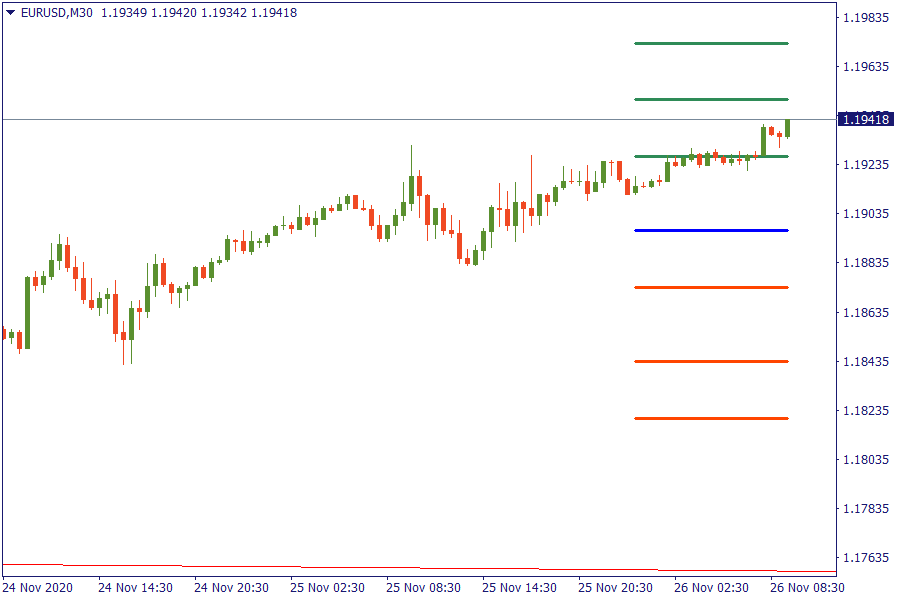

EUR/USD: is it the time to touch 1.20?

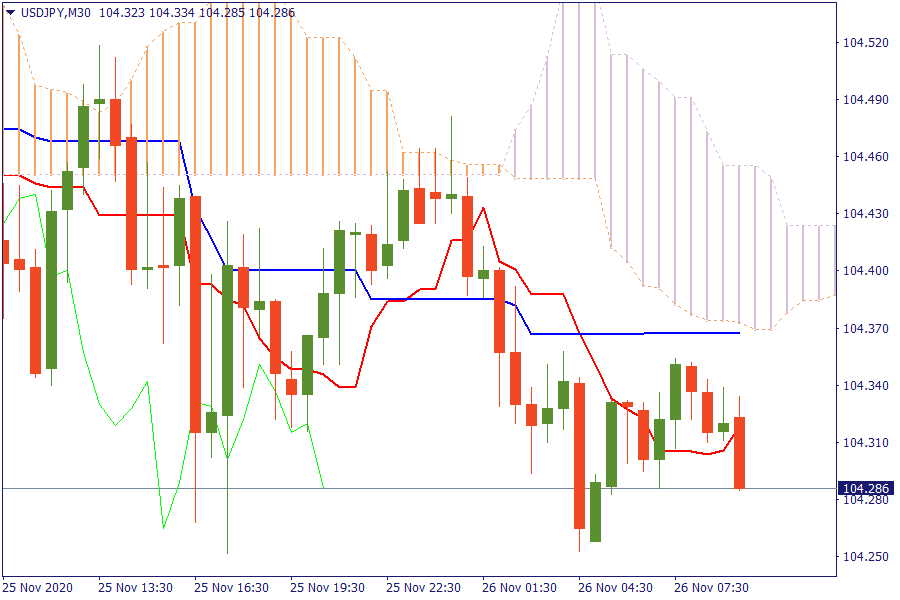

Ichimoku Kinko Hyo

USD/JPY: The pair is trading below the cloud. A downward pressure would lead the pair to exit further the cloud, confirming a bearish outlook.

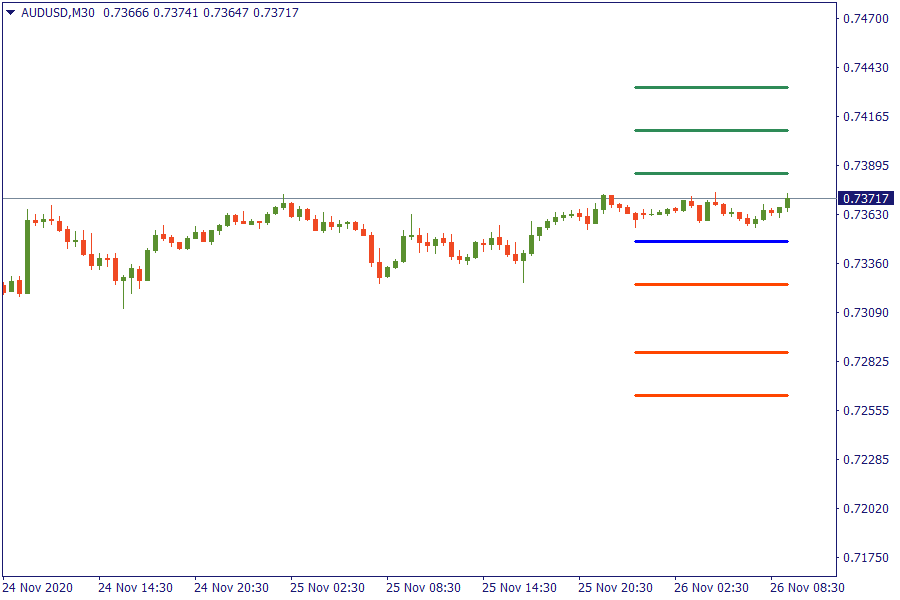

Fibonacci Levels

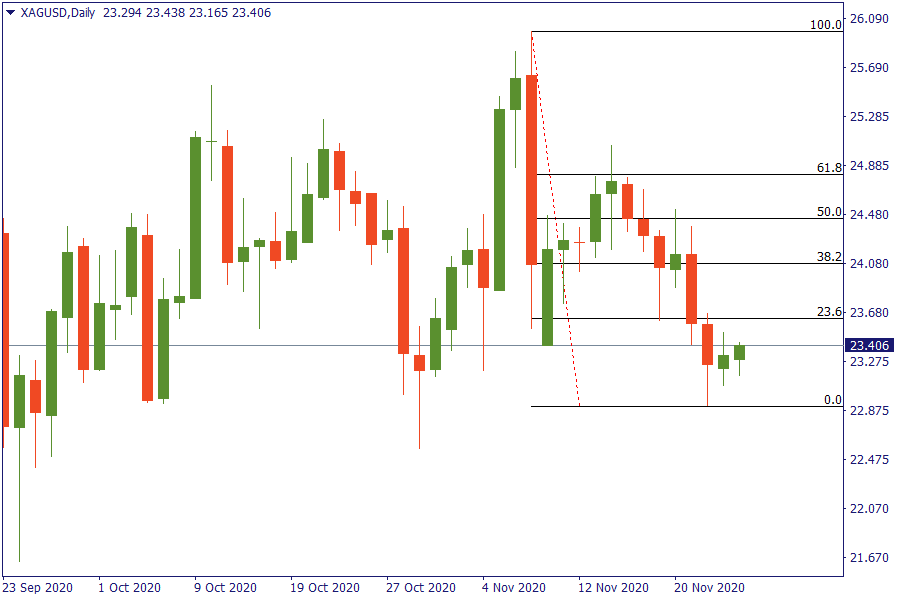

XAG/USD: Silver in the daily chart shows a significant weakness and bears still hold price below the key retracement resistance area of 23.6%.

EU Market View

Asian shares advanced on Thursday as market euphoria over COVID-19 vaccines and expectations a Biden administration would deliver more economic stimulus and political predictability overrode a slate of weak US economic data. In the currency market, the US dollar stayed under pressure as riskier currencies benefited from the increased optimism. In commodities, oil prices rose for a fifth day as a surprise drop in US crude inventories added to the positive mood stemming from hopes of demand recovery. Looking ahead, highlights from the macroeconomic announcement include the Riksbank policy announcement, ECB minutes, ECB's Lane & Schnabel, US Thanksgiving Holiday.

Minutes from Fed's last policy meeting showed policymakers consider giving markets a better steer on how long they will continue to buy bonds to support an economy under siege from new coronavirus infections.

EU Key Point

- Germany December GfK consumer confidence -6.7 vs -4.9 expected

- Germany reports 22 268 new coronavirus cases in the latest update today

- Italian top official calls for ECB to consider canceling the pandemic debt

- China Securities Journal says some stimulus exit very likely, but no rate hike soon

- China state media warn Biden of tensions and turbulence re Taiwan clarity

- South Korea daily confirmed coronavirus cases today above 500, for the first time since March