Gold Trade Update

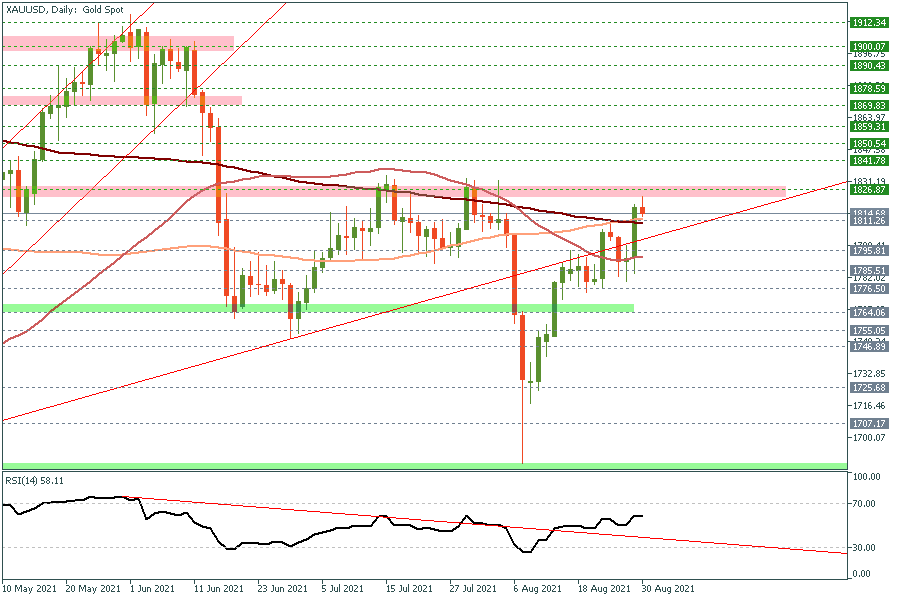

Daily Chart

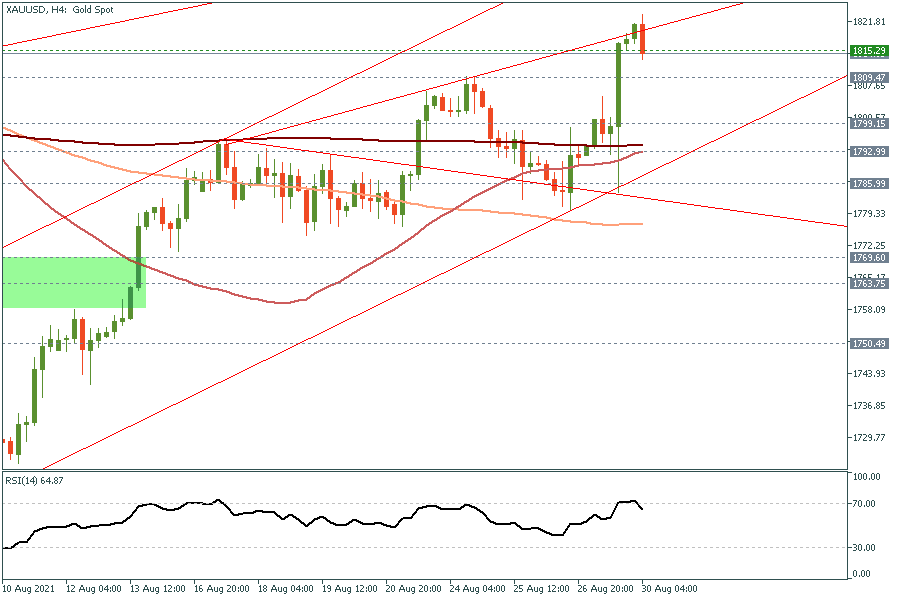

4H Chart

Gold managed to post further gains at the end of last week's trading amid fears of Covid19-Delta variant, in addition to the Federal Reserve's remarks about QE tapering. Despite multiple hawkish remarks by non-voters including Bullard, the Fed's chairman made it clear that tapering is coming later this year, but the Fed is not in a rush to taper. Such remarks were enough for gold to break above 1800, all the way to 1811 target mentioned in our previous reports. With that being said, our medium-term long positions from 1730 which was issued few weeks ago has +$80 profit so far and it would be wise to move our stop loss now to 1780 to reserve more profit and protect our positions. In the meantime, Gold may retrace to retest $1800 support area, but its likely to hold before the next leg higher, which may test $1830 later this week.

| S3 | S2 | S1 | Pivot | R1 | R2 | R3 |

| 1738.86 | 1773.06 | 1795.32 | 1807.26 | 1829.52 | 1841.46 | 1875.66 |