Bearish scenario: Sell below 2200 / 2194 ... Nearest bullish scenario: Buy above 2197... Bullish scenario after retracement: Consider buys around each indicated demand zone

2021-09-07 • Updated

Gold and cryptocurrencies demonstrate a correlation since 2021. These assets have equal conjecture as both have limited emission. That fact provides these assets with a status of “haven”, which means traders prefer to purchase them during periods of high market volatility and at the moments when high inflation risks occur.

Ethereum, daily chart

As you can see Ethereum price created two minimums and the maximum at February 28, March 25, and May 12 respectively.

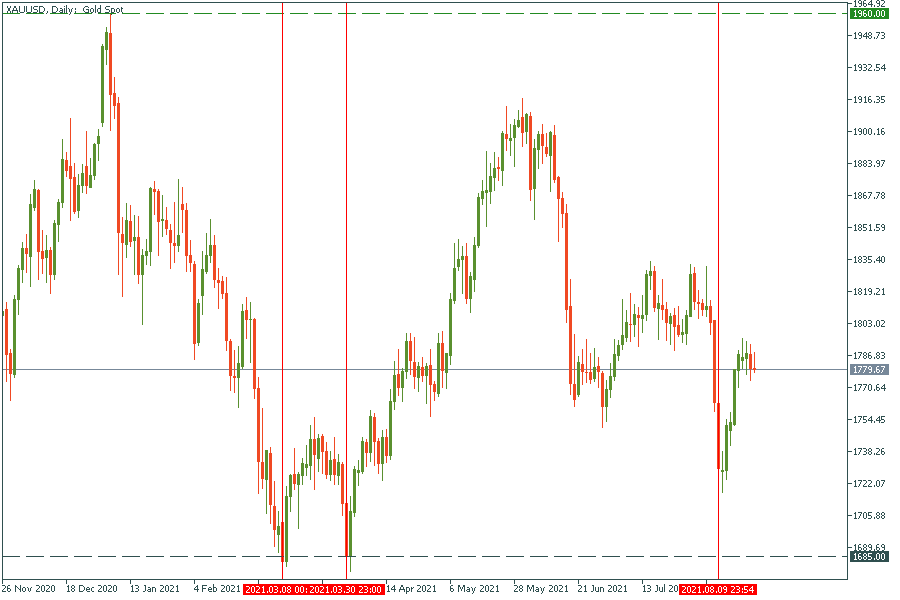

Gold, daily chart

Gold price drew double bottom on March 8 and March 30, approximately a week after Ethereum did. Also, it gained the highest point on June 1, approximately 2 weeks after crypto did.

Lately crypto market dropped on July 20 and Gold followed it on August 9.

At the moment, the crypto market demonstrates extreme growth. Do you have any suggestions about gold’s future? Let’s check it!

30 min, Ethereum chart

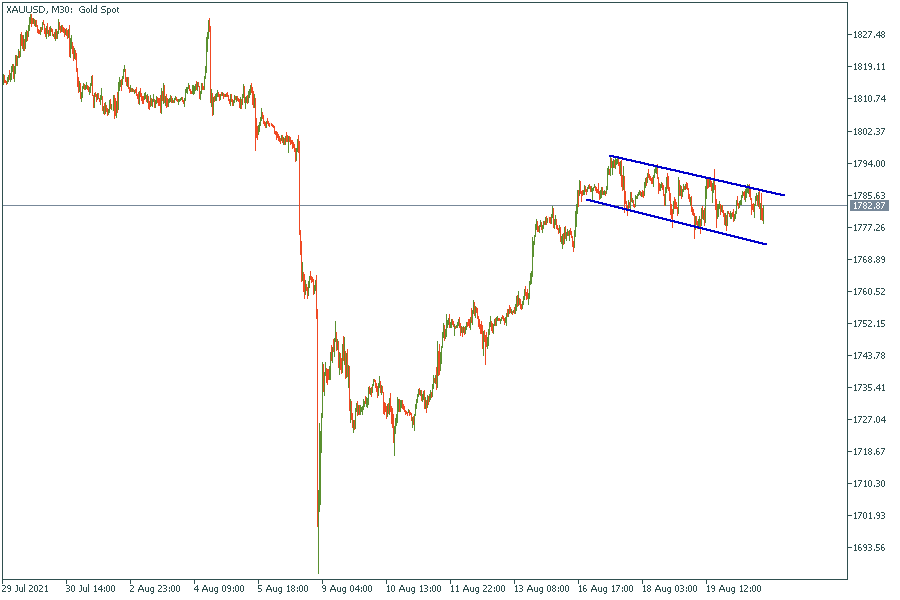

30 min, gold chart

Bearish scenario: Sell below 2200 / 2194 ... Nearest bullish scenario: Buy above 2197... Bullish scenario after retracement: Consider buys around each indicated demand zone

Gold prices rose on Monday as the US Dollar weakened amidst speculation about potential Federal Reserve rate cuts starting in June. This weakened Dollar was partly due to improved risk sentiment pushing US Treasury yields lower. Despite facing challenges from declining yields, gold prices recovered to nearly $2,170 per troy ounce, driven by the Dollar's weakness. Federal Reserve Chair...

Gold prices bounced back on Wednesday, reaching $2,173.60 after briefly dipping to $2,150.00. Traders speculate that the US Federal Reserve (Fed) might reduce borrowing costs, but a recent report showing higher-than-expected inflation in the US could delay such actions. Despite signs of a cooling labor market, the US economy remains robust, with inflation

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!