On Wednesday, June 15, USDJPY hit the highest level since January 2002 at 135.57.

In-depth technical & fundamental analysis for currencies & commodities

On Wednesday, June 15, USDJPY hit the highest level since January 2002 at 135.57.

Last week was intense! The US dollar gained more than 2% against other currencies on investors' concerns regarding one more inflation wave in the United States caused by the fuel crisis…

The euro area (EA) faced a 7.4% annual inflation in April, and the European Union (EU) had an 8.1% price growth. Rates hikes are crucial for the economy to stop collapsing; still, the ECB is doing nothing but talk. Step by step, we’ll find out what will happen with Europe.

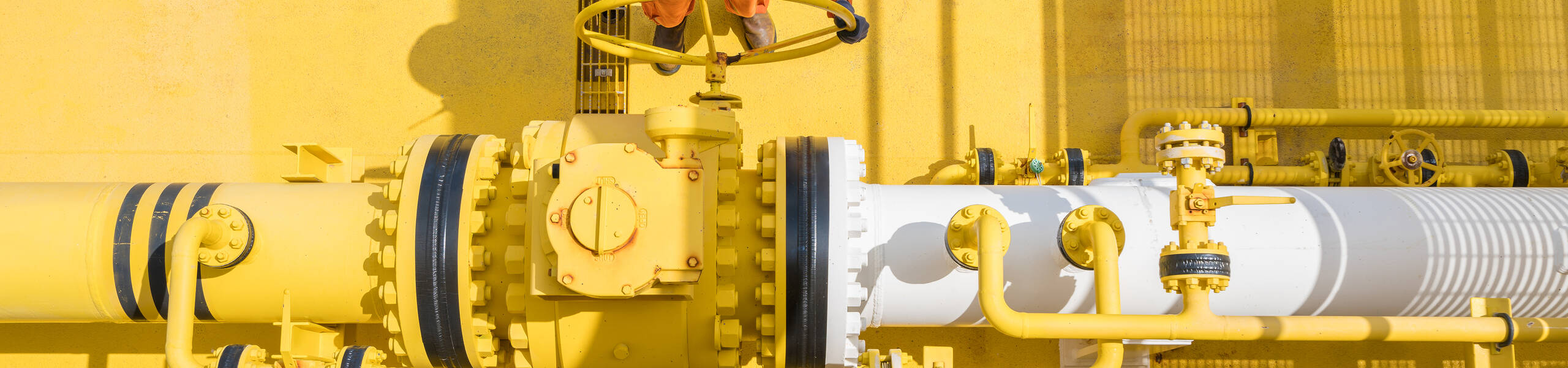

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

Elon Musk is famous for his statements and tweets that spread around news headlines in a moment and provoke a lot of buzzes…

The US Fed is speeding up its monetary tightening, and crypto may experience the most challenging times since the beginning of the market. Commodities are in danger, too. Dive deeper into the most important events of next week!

Recently, the Bank of Canada hiked the interest rates by 50 basis points. It is now 1.5%, and it’s only the beginning.

On Thursday, June 2, the Organization of the Petroleum Exporting Countries Plus (OPEC+) agreed to boost output by 648 000 barrels per day (bpd) in July and August…

China’s stock market performed well last week amid weakening lockdown measures. Traders are becoming bullish and greedy. Should we follow the crowd and buy HK50?

What happened? US stocks ended sharply higher on Thursday, May 27, after a 7-week losing streak…

Next week, we expect the BOC rate statement, the OPEC+ meeting, and the Nonfarm payrolls release. Let's look at the opportunities in detail!

Amazon announced the company is going to make a 1 – 20 stock split on June 3 after the trading session close (23:30 GMT+3).

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!