Avoid chasing after the "holy grail" strategy. Success is built on a well-thought-out, adaptable, and disciplined approach rather than seeking an elusive secret formula.

16. Ditch the paycheck mentality

Trading isn't a fixed-income, nine-to-five job. Avoid approaching it with a paycheck mindset. Profits fluctuate, and understanding this volatility is essential to grow your trading account.

17. Don't count your chickens

Anticipating profits prematurely can lead to hasty decisions. Wait until a trade reaches its logical conclusion based on your strategy rather than prematurely celebrating potential gains. This aligns with the importance of maintaining discipline in trading rules.

18. Embrace simplicity

Complexity doesn't ensure success. Simplify your trading strategy, focus on vital indicators, and avoid unnecessary complexities for better trading performance.

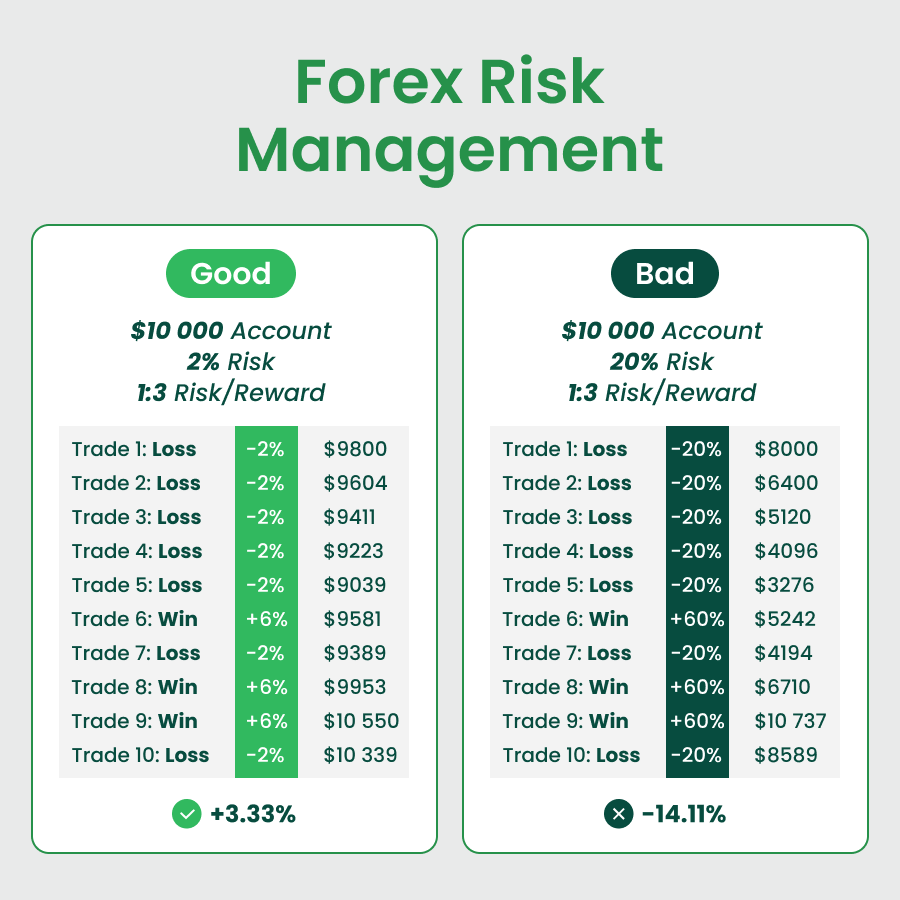

19. Make peace with losses

Accepting losses as part of trading helps maintain emotional stability and aligns with the golden rules of forex trading. Learn from your losses to grow and improve future strategies rather than lament them.

20. Beware of reinforcement

Reinforcement can lead to repetitive, often impulsive behaviors based on past successes. Stay vigilant against overconfidence and stick to a well-defined plan.

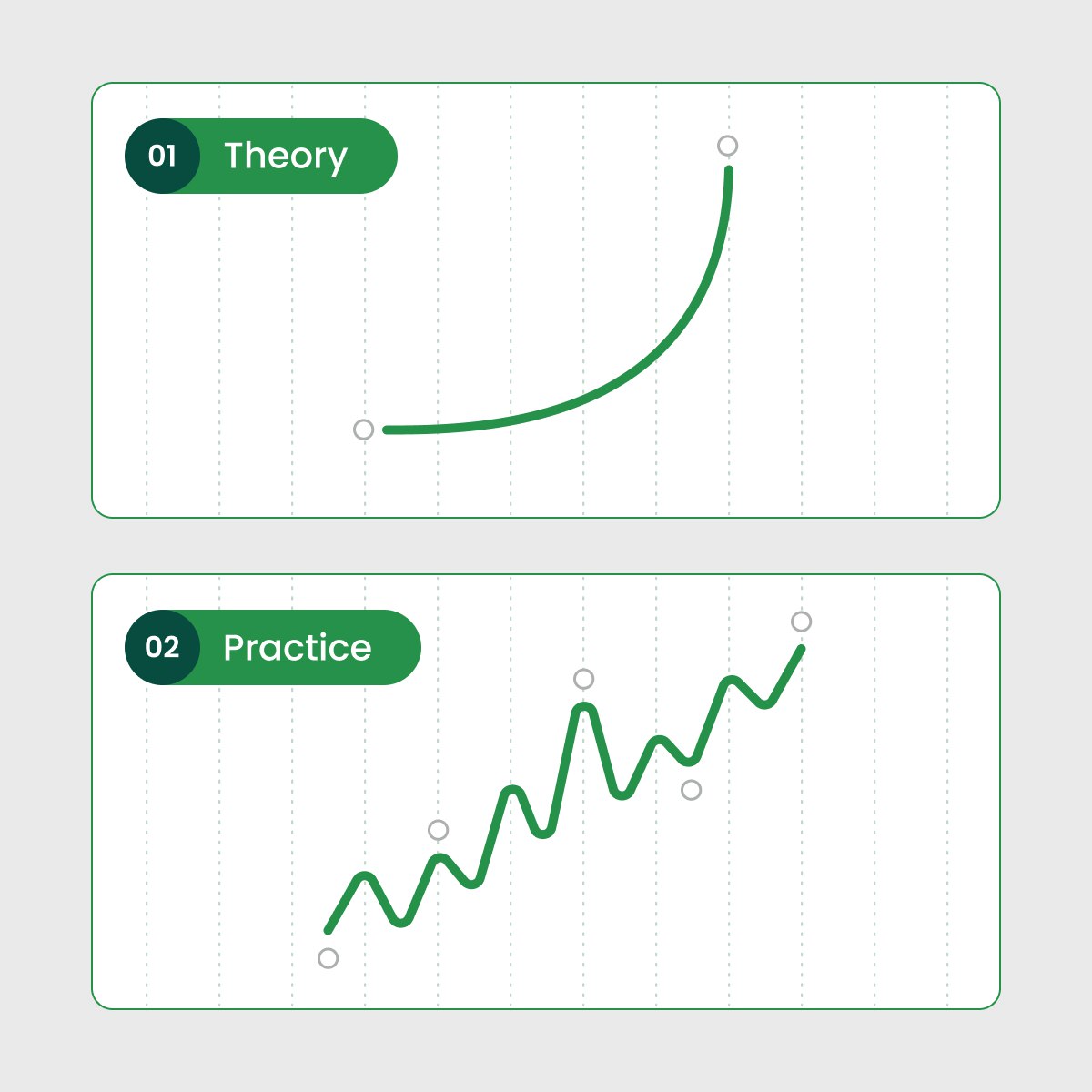

The journey to becoming a successful trader involves continuous learning and adaptation. Master these 20 trading rules and integrate them into a comprehensive trading plan and mindset.

The art of trading is both a science and an art. It involves analyzing data, understanding market psychology, managing risks, and making timely decisions. It demands discipline, patience, and a commitment to ongoing education.

Conclusion

In conclusion, the 20 crucial trading rules aren't just a set of guidelines; they're a compass guiding traders through the ever-changing tides of the financial markets. Mastery in trading isn't achieved overnight; it's a journey paved with dedication, continuous learning, and a willingness to adapt.

Successful traders aren't merely participants in the market; they're strategists, risk managers, psychologists, and lifelong learners. Embracing these rules and evolving with the market dynamics is the path to sustained success in the captivating world of trading.

Frequently Asked Questions (FAQ)

What is the most important rule in trading?

Disciplined risk management is pivotal. By controlling risks and preserving capital, traders safeguard against substantial losses, ensuring sustainability in the market.

What is the 90% rule in trading?

The 90% rule is a commonly cited statistic, stating that 90% of novice Forex traders lose 90% of their money in the first 90 days. This rule reminds traders of the harsh reality of trading and the importance of risk management and effective strategy.

What are the golden rules of trading?

Disciplined risk management, adherence to a trading plan, avoidance of emotional decisions, continuous learning, and adaptability to market conditions encompass the golden rules of trading. These principles act as guiding beacons for navigating volatile markets.

What is the number one rule in day trading?

Effective risk management takes precedence in day trading. Implementing stop-loss orders to limit potential losses and maintaining discipline with predefined entry and exit points are fundamental strategies for successful day trading.