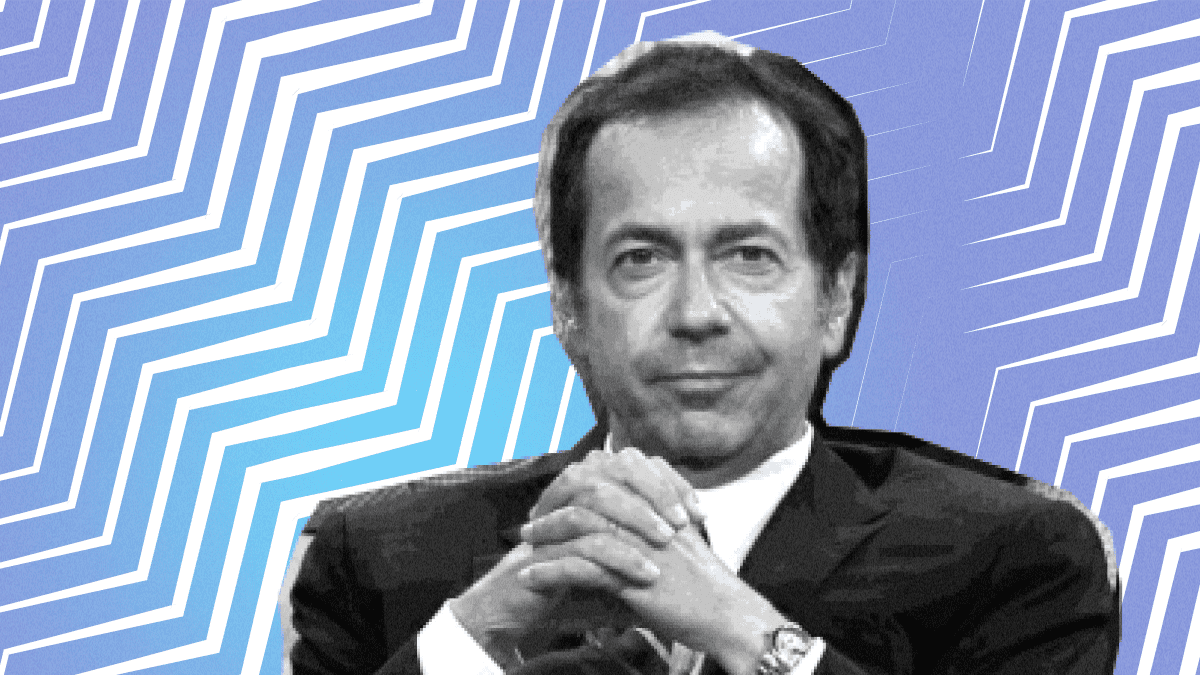

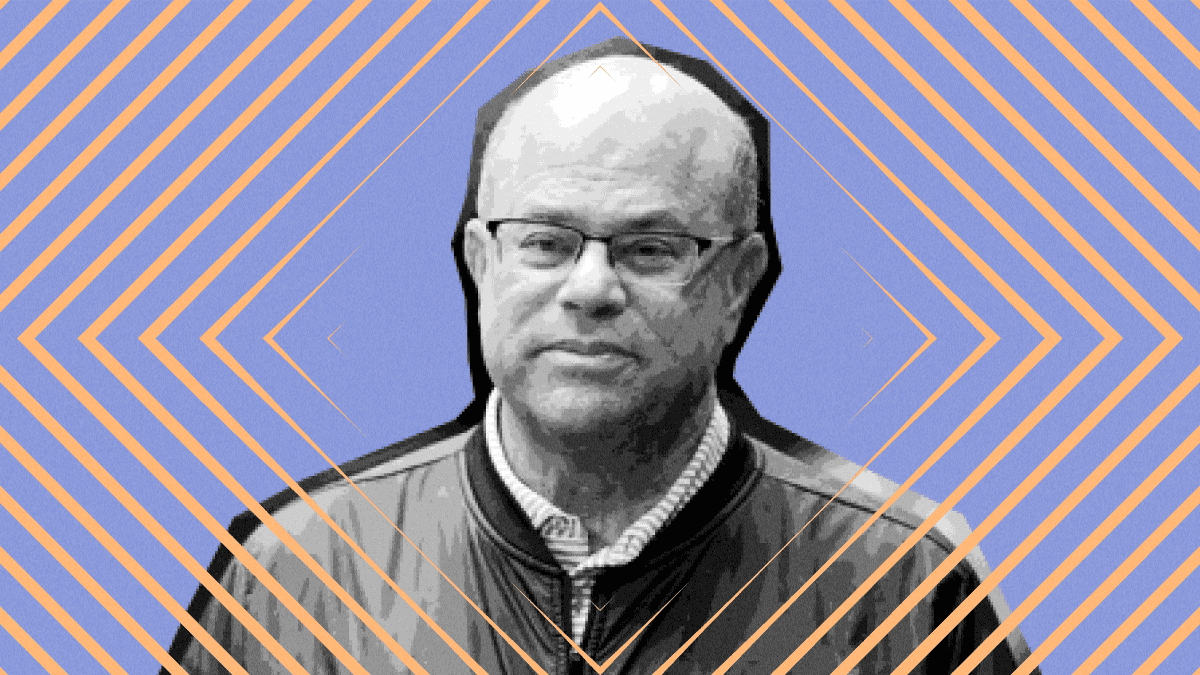

7. John Paulson

Forbes, the Guardian, New York Times, and many other media wrote about John Paulson, “the greatest trader ever,” born in 1955.

Paulson started his career at Boston Consulting Group in 1988, giving advice to companies. After changing several works, he founded his hedge fund, Paulson & Co., with $2 million and one employee in 1994. By 2003, his fund had risen to $300 million in assets.

John Paulson’s fame and fortune came during the global financial crisis of 2007–2008 when he earned nearly $4 billion and “went from obscure money manager to financial legend.” Before the collapse, he bought used credit default swaps and used them to bet against the US subprime mortgage market effectively. Some call it the greatest trade in history.

In 2010, Paulson made $4.9 billion, mainly investing in gold. Forbes estimated his net worth at $3 billion in January 2023.

However, John’s losing investments in some stocks caused investors to flee his hedge fund, Paulson & Co, cutting its assets under management to $10 billion as of January 2020 from a high of $36 billion in 2011.

The billionaire showed the possibility of diversifying not only assets but also strategies, combining conservative arbitrage strategies and frankly speculative ideas with the mandatory division of funds.

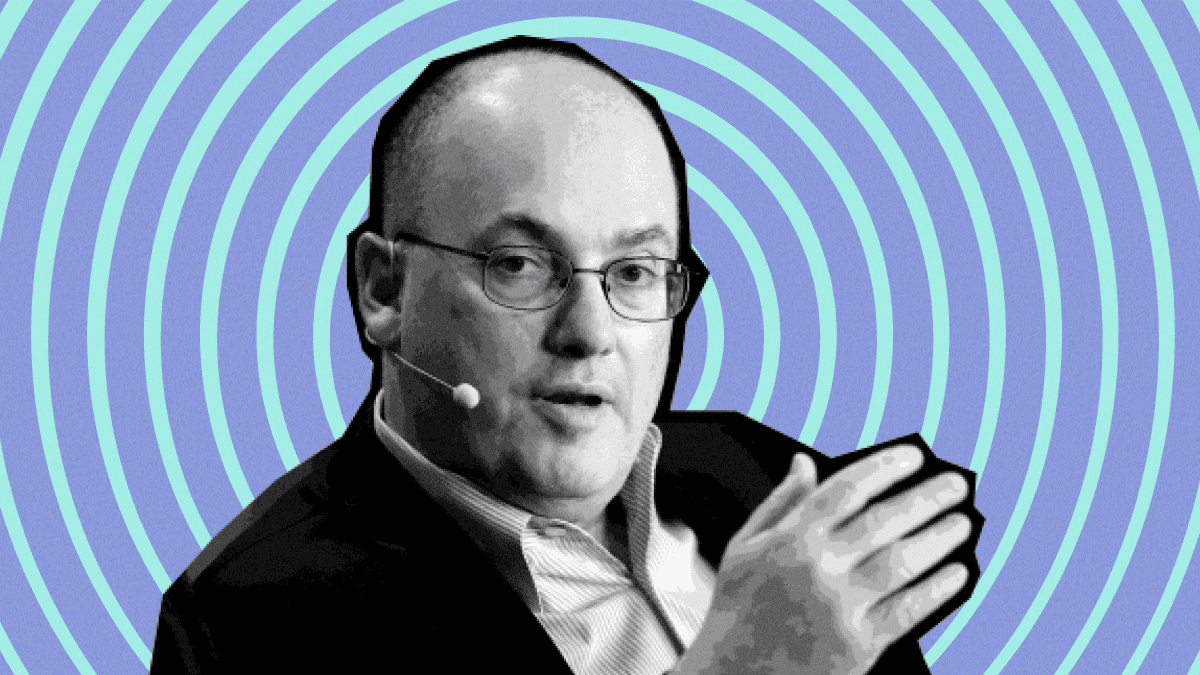

8. Steven Cohen

Steven Cohen was born in 1956 in New York. Being an avid poker player, Stephen spent all the money he earned from cards on stock speculation while still studying at the University, running away during breaks to the nearest Merrill Lynch bank office.

With a current net worth of around $16 billion, Cohen started his career at the investment banking firm Gruntal and, thus, entered the stock market in 1978.

Cohen began by earning $8 000 on his first day and then moved on to make $100 000 a day for the firm. In 1992, he quit Gruntal and founded one of the most successful hedge funds, SAC Capital Partners. By 2013, the average annual gain for SAC had reached 25%.

Although Steven reached success and became wealthy, his journey was not only about victories but also about several losses. In 2010, SAC was investigated for insider trading launched by the Securities and Exchange Commission (SEC). While Cohen was not charged, the company pleaded guilty and paid $1.8 billion in fines. Later, he was forced to shut down his fund.

But Steven Cohen became known for his ability to succeed and earn under any conditions. He is also a famous stock trader who prefers risks and winning big. Now he is the founder and CEO of Point72 Asset Management, a family office in Stamford, Connecticut.

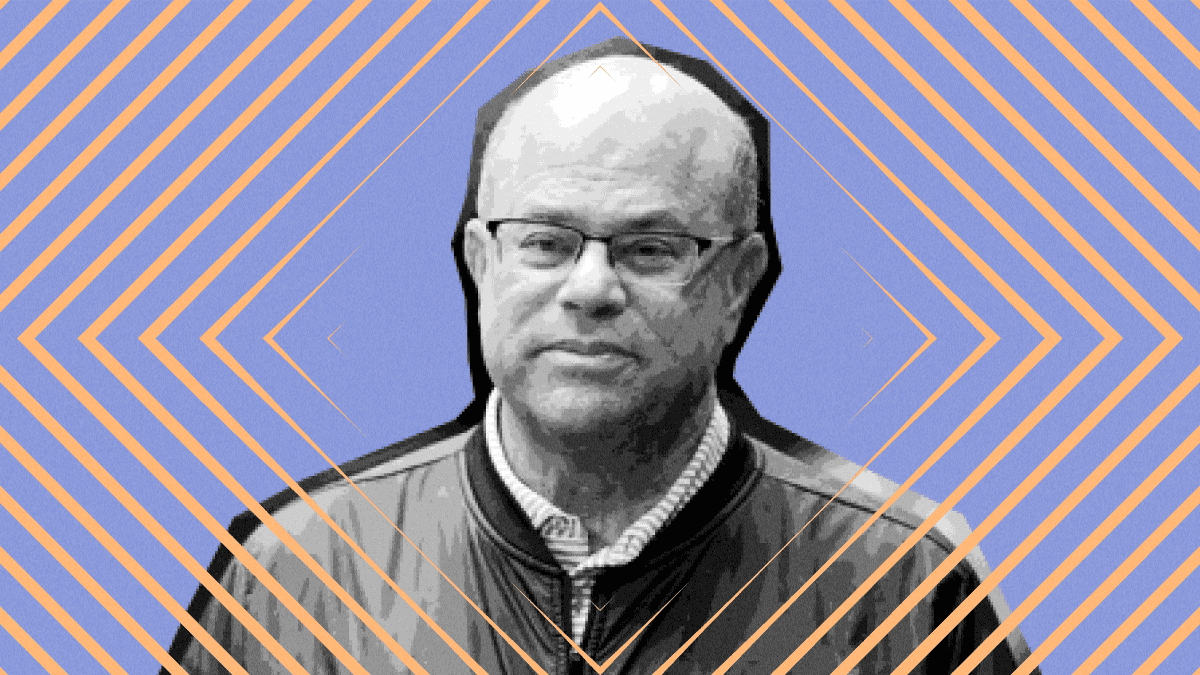

9. David Tepper

The richest man, successful hedge fund manager, and philanthropist, David Tepper, was born in 1957 in a Jewish family. David entered the market being still in college. He graduated with a BA in economics from the University of Pittsburgh and obtained his MS from Carnegie Mellon University in 1982.

After graduation, Tepper got a job at Equibank as a credit analyst and was involved in the finance industry. Then, he changed several companies, including Keystone, and was recruited to Goldman Sachs for eight years with a primary focus on bankruptcies and special situations. David played a major role in Goldman Sachs’s survival after the 1987 stock market crash. He bought basic bonds in the crashed financial institutions, which soared in value once the market recovered.

But Tepper strived to run his own fund and traded aggressively to collect enough money for this. In early 1993, he founded Appaloosa Management. One of the earliest and biggest profits was made by investing in Conseco and Marconi. Subsequently, Appaloosa established itself as a hedge fund specializing in distressed debt, connected to investing in global public equity and fixed-income markets.

In 2009, Appaloosa earned about $7 billion by buying distressed stocks that were recovered that year. $4 billion of those profits went personally to Tepper, making him the top-earning hedge fund manager of 2009.

David Tepper’s net worth is $16.7 billion, according to Forbes. In 2020 the largest parts of his portfolio were Alibaba with 13% and Amazon with 11%.

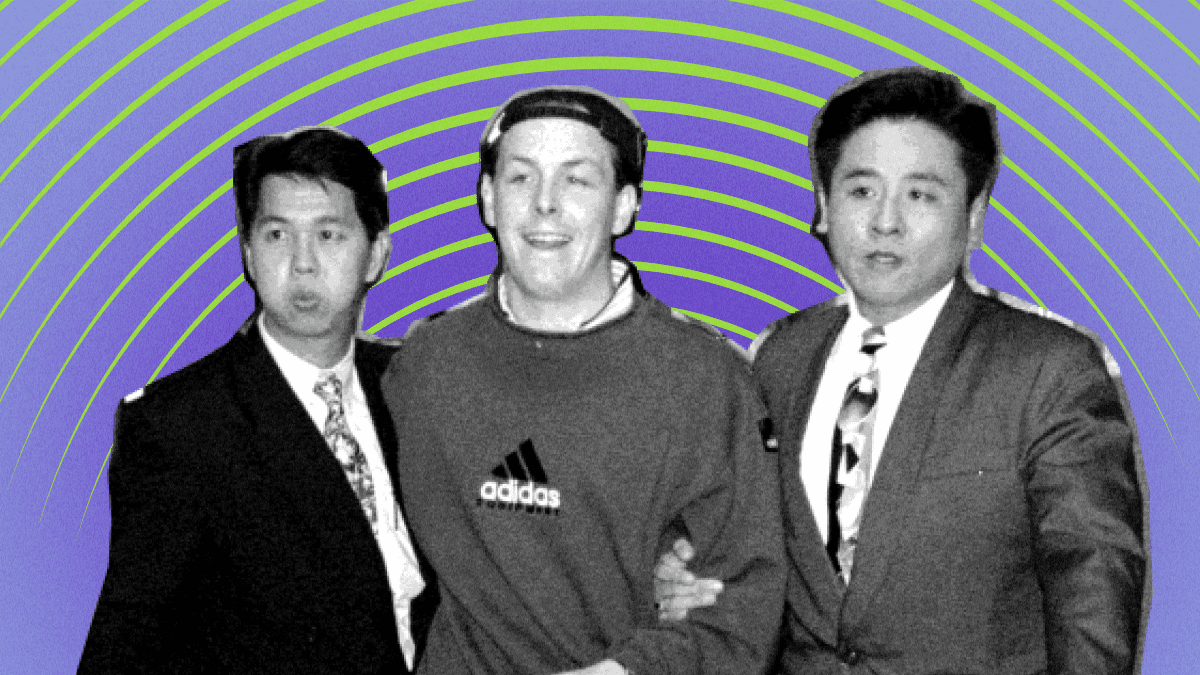

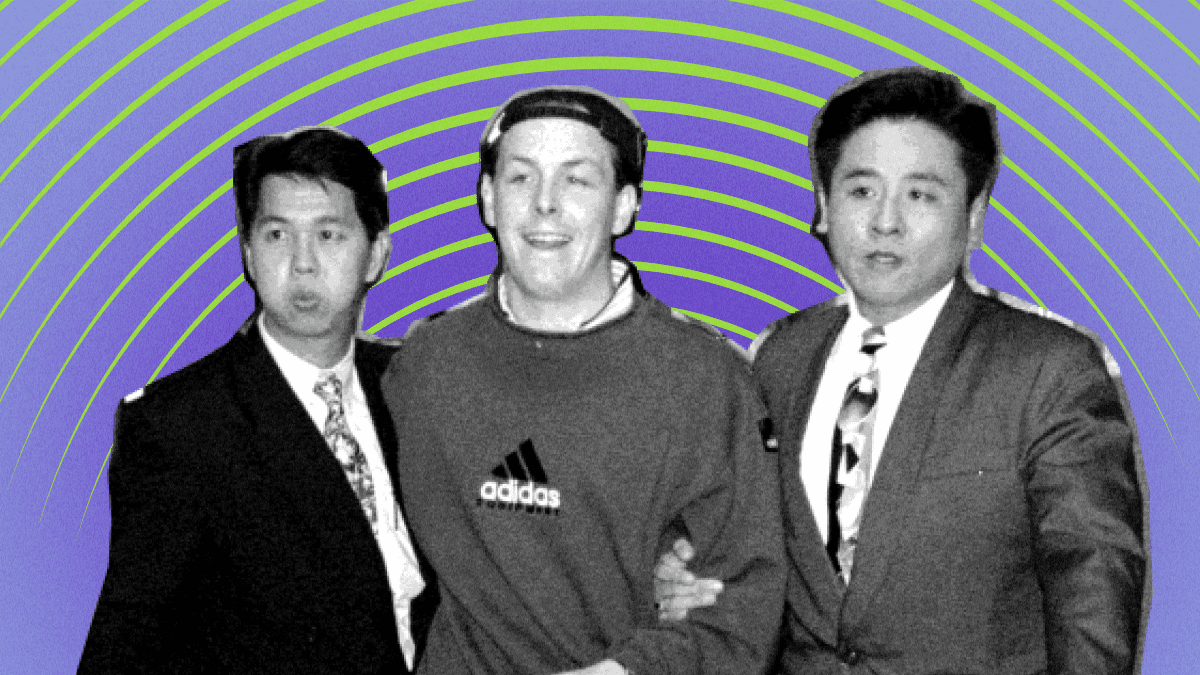

10. Nick Leeson

Notorious for bankrupting Barings Bank, Nick Leeson was born in 1967. With no higher education, he did a paper job at the Coutts bank that didn’t require special skills.

But Nick kept advancing his financial knowledge and soon moved to Morgan Stanley, where he was taught how to calculate futures and options quickly. Then, he was hired by Barings Bank and later went to Asia on the Singapore International Monetary Exchange (SIMEX.)

Here his famous story started. In April 1992, Barings opened a Futures and Options office in Singapore, executing and clearing transactions on SIMEX. Being 26 years, Nick Leeson, besides his trading activity, headed the futures and options back office in Singapore and began making unauthorized speculative trades.

First, these trades made big profits for Barings, adding £10 million, 10% of the company’s annual profit. Nick even got a bonus of £130 000 to his salary of £50 000. But then the fortune turned away, and Lesson started actually using the bank’s money with a special error account to cover bad trades by himself and others.

In 1995, the biggest loss and the end for Nick Leeson and Barings happened. Leeson bought a huge amount of futures contracts to press the market, but a strong earthquake of 7.2 magnitudes in Japan led to the collapse of these assets. As a result of the greatest scams, Barings Bank, with a 233-year history, suffered losses of $1.4 billion and was sold to the Dutch conglomerate ING for £1.

Leeson escaped from the bank, leaving a three-word note “I’m sorry.” He hoped to avoid Singapore prison but was detained and extradited by Germany to Singapore, where he served four years in a local prison. The total sentence was 6.5 years. Leeson contracted cancer while in prison, but the best Singaporean doctors treated the world-famous prisoner, and he recovered.

Today, Nick cannot hold any position on the stock exchanges but still makes more than 100 000 dollars a month for his conferences.

Following the successful trader’s lead, many of their peers became rich. Their stories might be controversial, but they are still outstanding and discussed. And each trader in our list made the market for them and earned huge money.

So everyone with some generous idea can put it into practice in the FBS app, while newbies can use our products to develop their trading skills and learn to trade.