If you are familiar with trading, you probably know the basics of fundamental and technical analysis. Generally speaking, fundamental analysis answers the question “Why does the market move?” and technical analysis tries to find out “When will the price movement occur?” However, you may not know a type of analysis, which combines both fundamental and technical practices. This approach is called VSA (volume spread analysis) and it is widely used by stock traders. Here we will explain how the VSA can be applied in forex trading.

What is the VSA?

The VSA was invented by Richard D. Wyckoff, who started to trade stocks at the age of 15. At the end of the 20th century, Tom Williams improved on Wyckoff’s research and developed his own methodology. In his book called “Master the Markets,” he mentions the importance of price differences (spreads) as they pertain to volumes and closing prices.

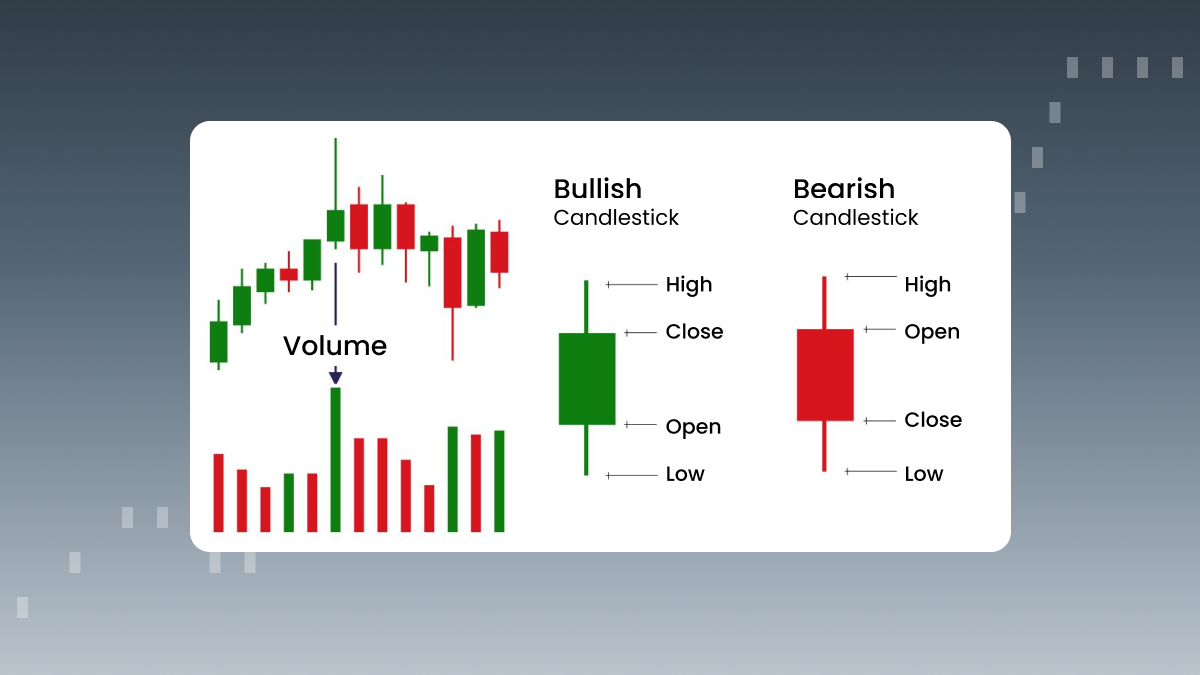

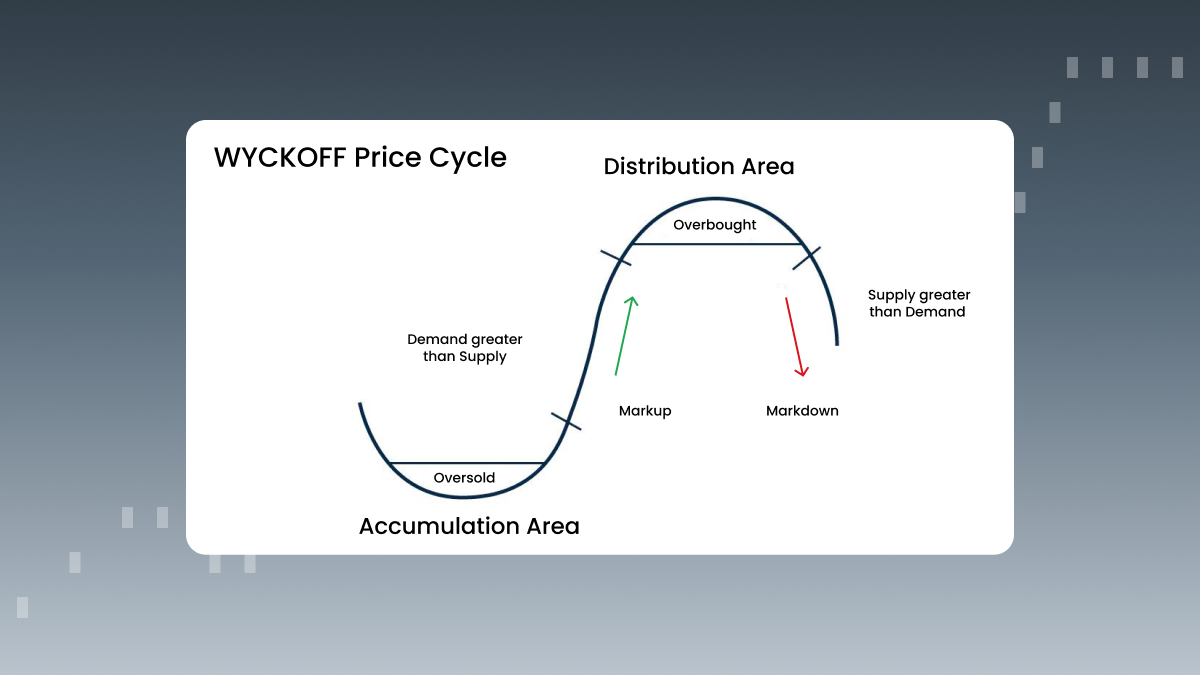

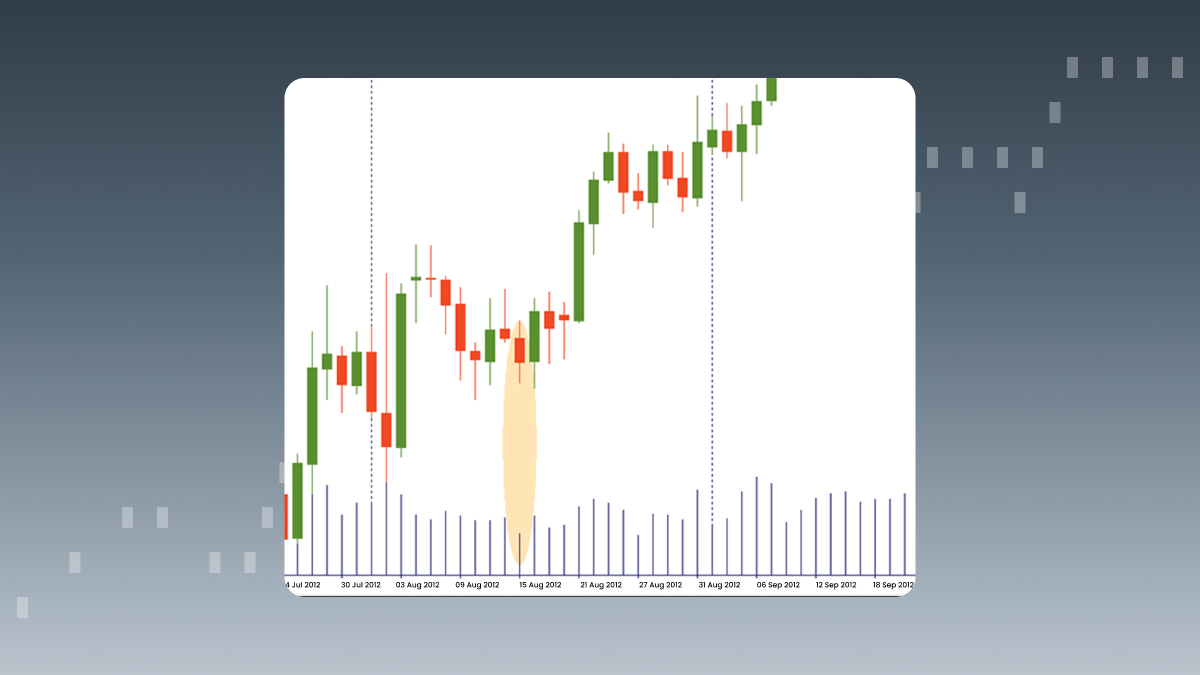

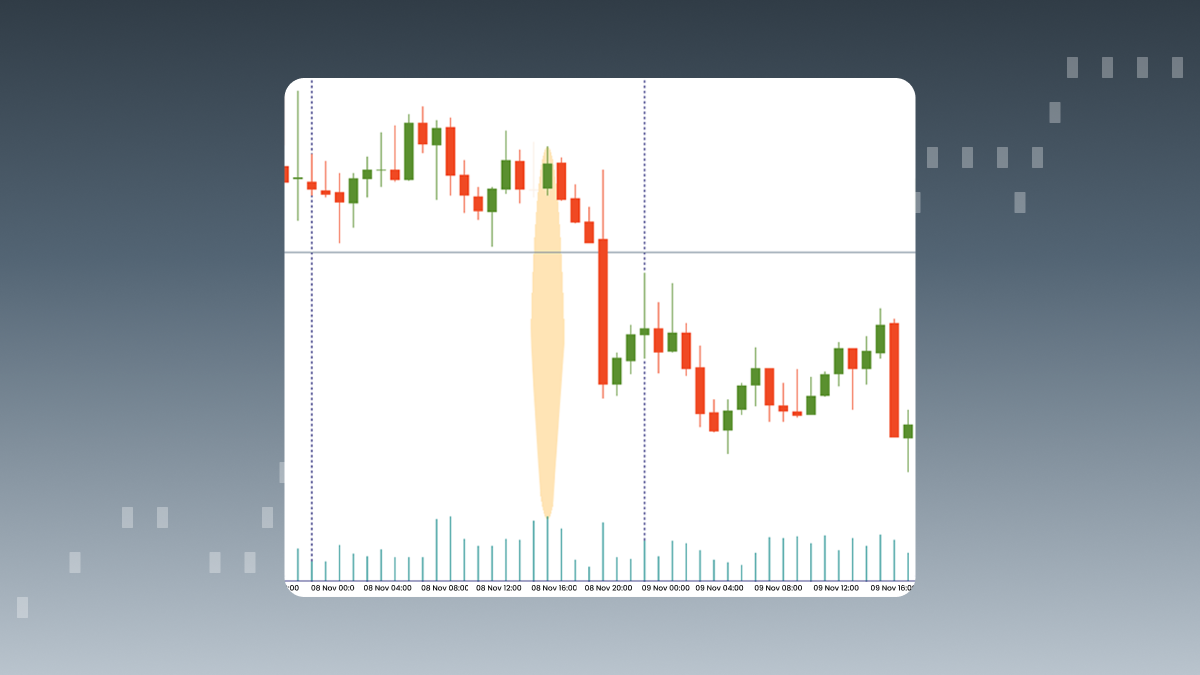

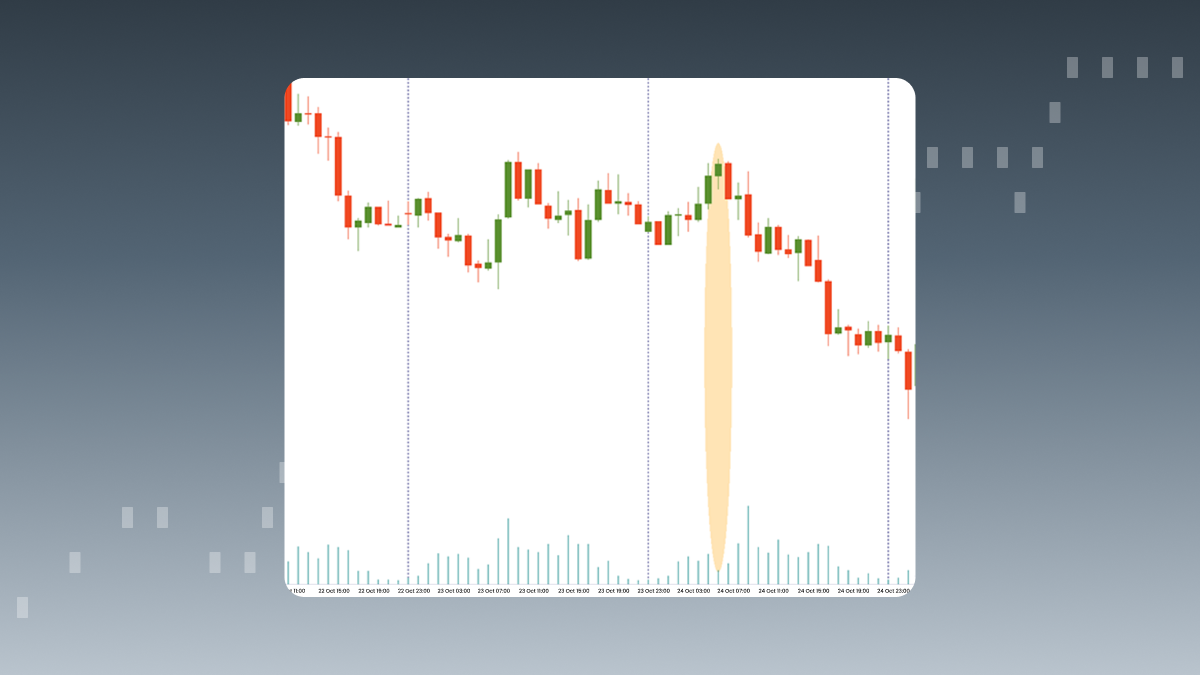

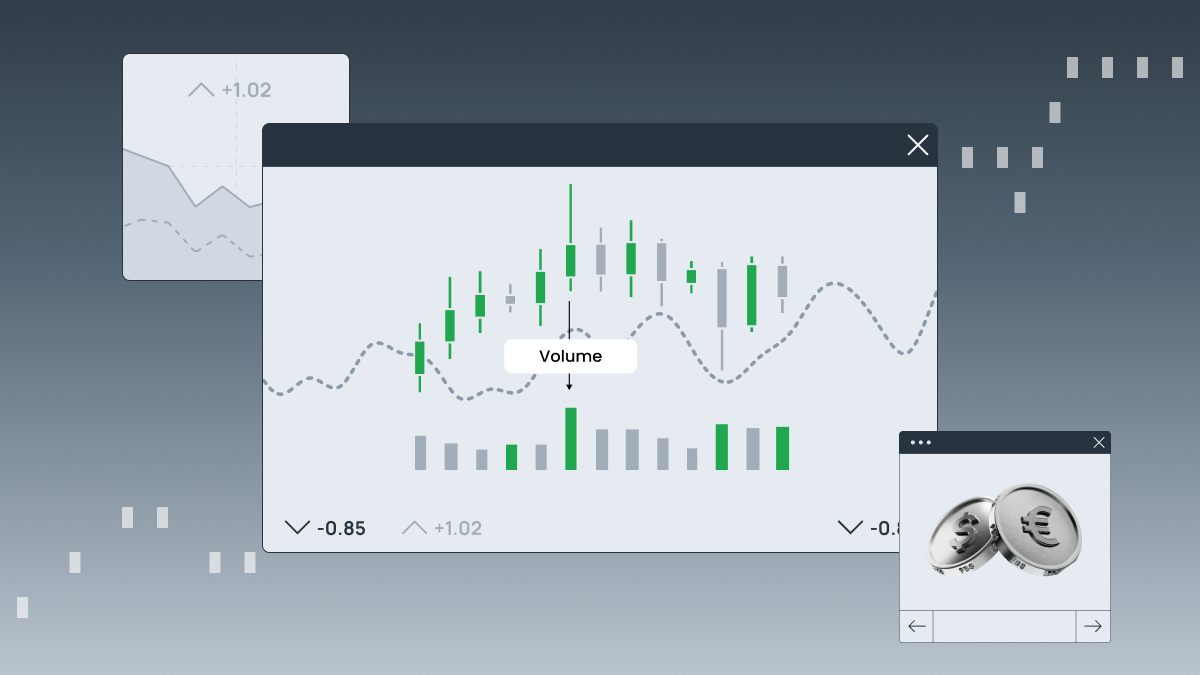

So what’s the VSA all about? Volume spread analysis is a type of analysis based on volumes and the candlestick spread. It tries to find out the differences between supply and demand created by the biggest players (professional traders, institutions, banks and market makers) on the forex market. If you know how to understand their actions, they may give you good signals to enter the market.

What makes up the VSA

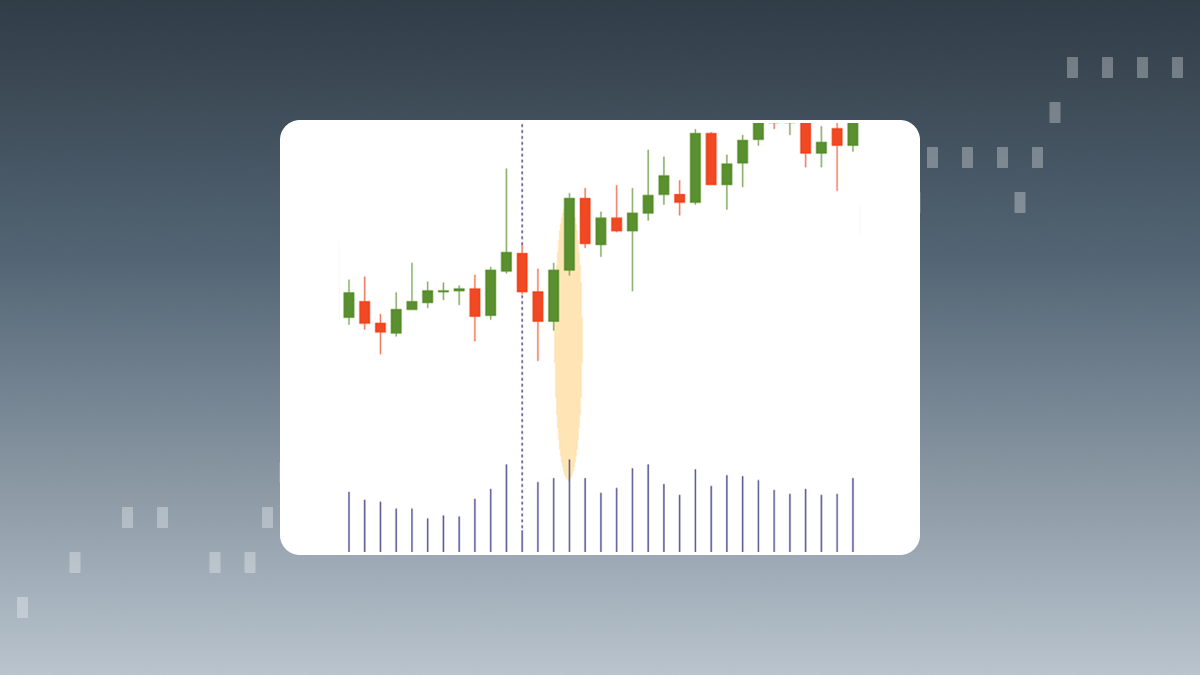

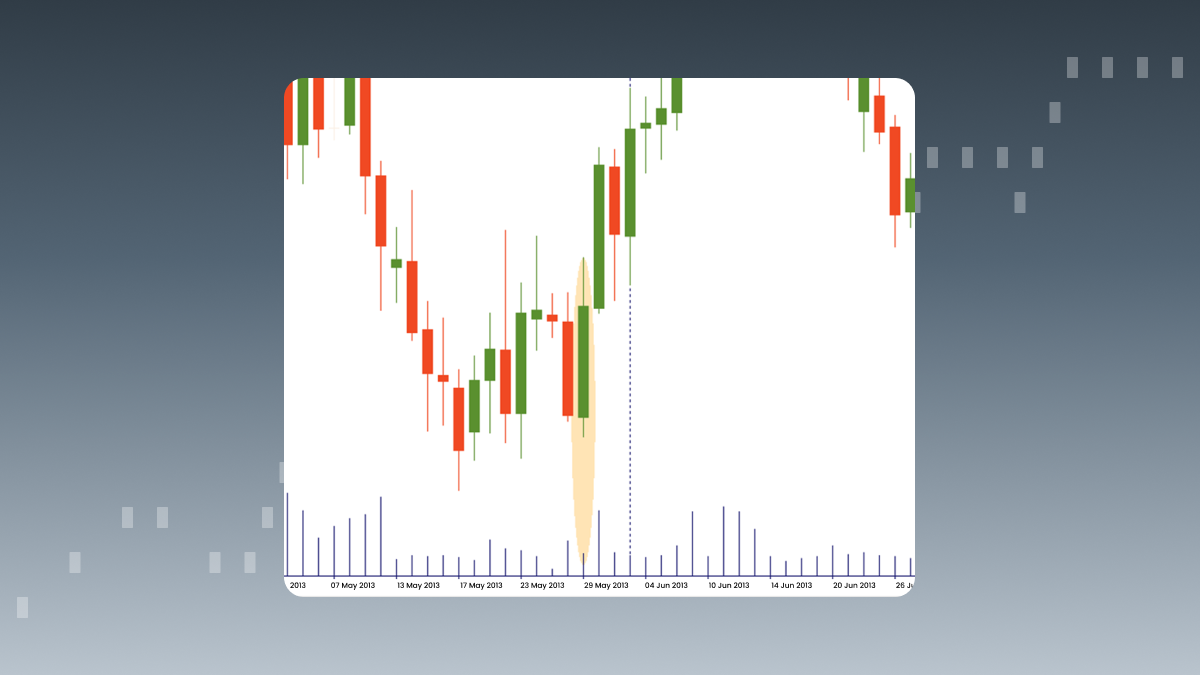

You need to determine three main variables to find out the balance between supply and demand:

The quantity of volume on a price bar.

The high and low of the price bar (the range).

The closing price.