Fundamental Analysis

The USD has been strengthening this week, driven by mixed U.S. economic data and increased demand for safe-haven assets amid global uncertainty. Against the AUD, the dollar has gained due to the weakness of the Australian dollar, which has been affected by falling commodity prices and the weak Australian GDP report.

Australia's Q2 2024 GDP showed sluggish growth of just 0.1%, in line with market expectations. This reflects ongoing economic challenges, including low domestic demand, increasing the likelihood of a rate cut by the Reserve Bank of Australia (RBA) later this year.

Technical Analysis

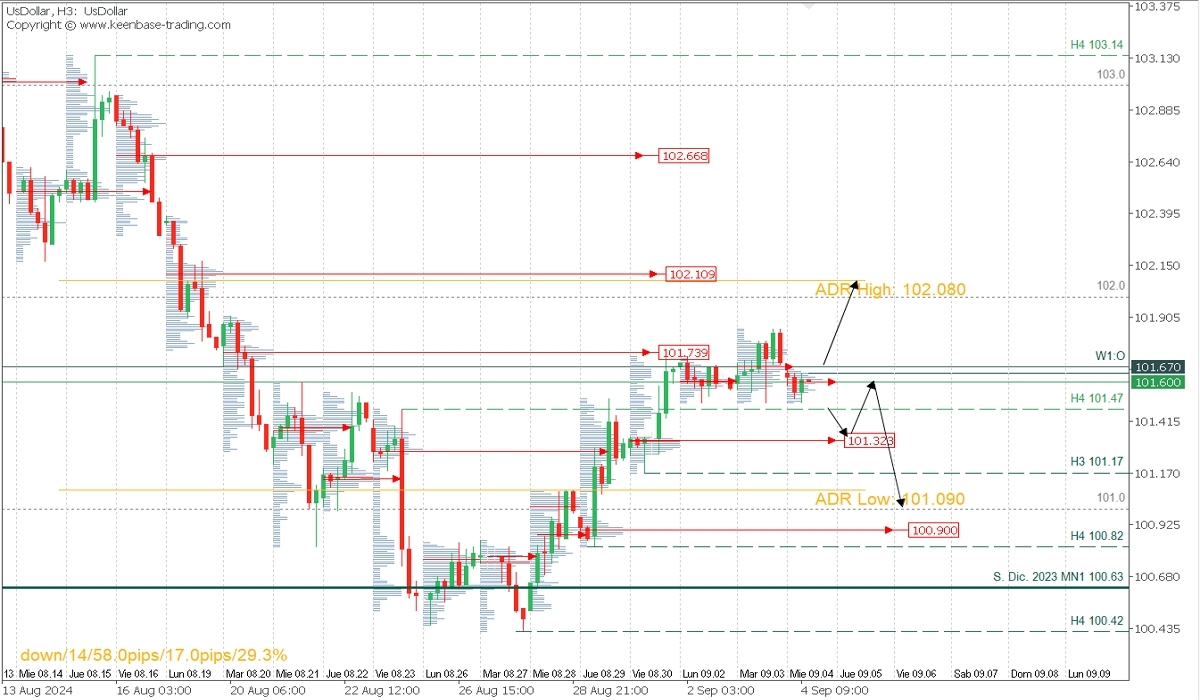

Dollar Index (USDX), H3

- Supply Zones (Sells): 101.73, 102.109, and 102.649

- Demand Zones (Buys): 101.319 and 100.90

The USD’s recovery and the confirmed breakout above the last validated resistance at 101.47 suggest an intraday upward trend reversal. After reaching the closest supply zone around 101.73 and a moderate pullback, an additional rally towards the next supply zone near 102.10 and 102.65 is expected. This bullish scenario remains valid as long as the current support at 101.17 holds. If breached, the bearish trend will resume, targeting the weekly support at 100.42.

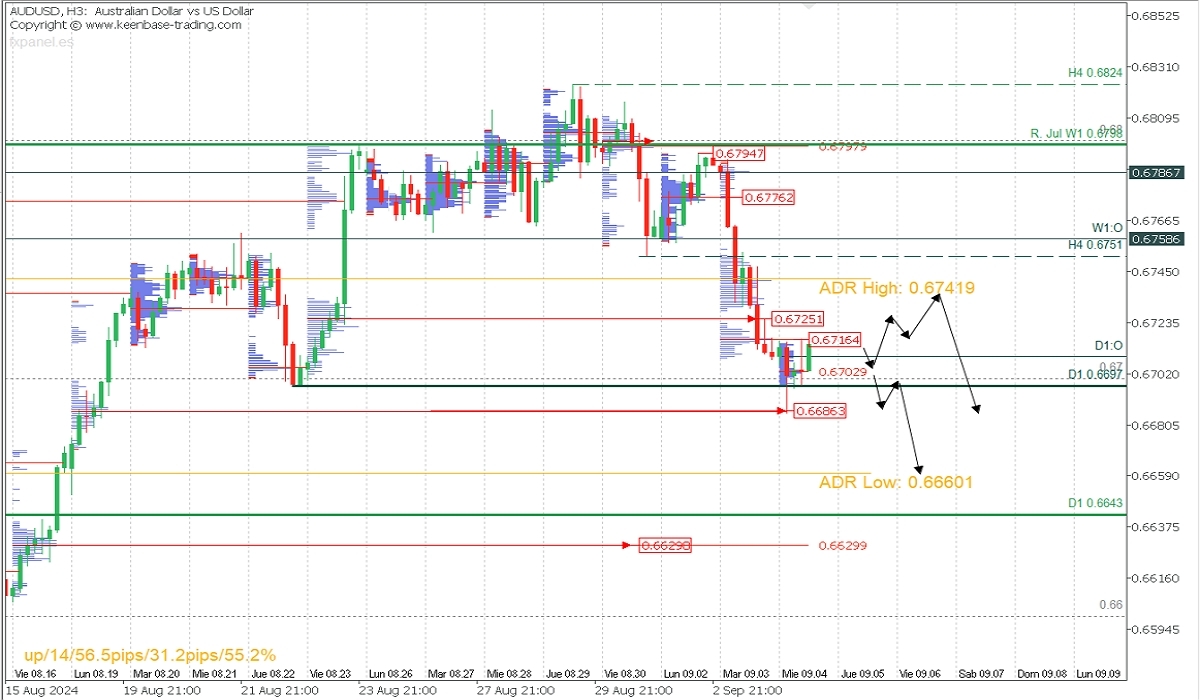

AUDUSD, H3

- Supply Zones (Sells): 0.6716, 0.6725, 0.6741, and 0.6776.

- Demand Zones (Buys): 0.6702, 0.6686, 0.6661, and 0.6630.

The pair faces a range between 0.6686 and 0.6725. As long as the price stays above the early session demand zone around 0.6702, the pair will seek to sell liquidity between 0.6716 and 0.6725. If surpassed, a further extension towards 0.6740/41 is possible, where new sell opportunities should be considered. Bearish targets are below 0.6686, towards the average bearish range at 0.6660, extending to the uncovered Point of Control (POC) at 0.6629. This bearish scenario is valid as long as the last validated resistance at 0.6794 is not breached.

*Uncovered POC: Point of Control (POC) is the level where the highest volume concentration occurred. If it precedes a downtrend, it forms a sell zone and resistance; if it precedes an uptrend, it’s a buy zone, typically located at lows, forming support.*

@2x.png?quality=90)