Fundamental Analysis

The US Dollar experienced intraday volatility and turned negative following the release of US services sector data from both S&P Global and ISM, which fell short of market expectations. The ISM Services PMI for November printed at 52.1, marking a significant slowdown from the forecasted 55.5, while the S&P Global Services PMI closed at 56.1, also below expectations. These results highlight a deceleration in the services sector, raising concerns about economic growth and weighing on the USD amid growing anticipation of a Fed rate cut in December, with a 73.8% probability according to the CME FedWatch Tool.

The ADP employment report also showed job growth of 146,000 in November, a slight miss compared to the expected 150,000, which failed to impact the market significantly. Despite hawkish remarks by St. Louis Federal Reserve Bank President Alberto Musalem, who warned that a December rate cut might be premature due to geopolitical tensions, investors are cautiously positioned ahead of Fed Chair Jerome Powell’s remarks today. In this context, traders will closely monitor Powell's speech for further insights into the direction of monetary policy in a slowing economic environment.

Technical Analysis

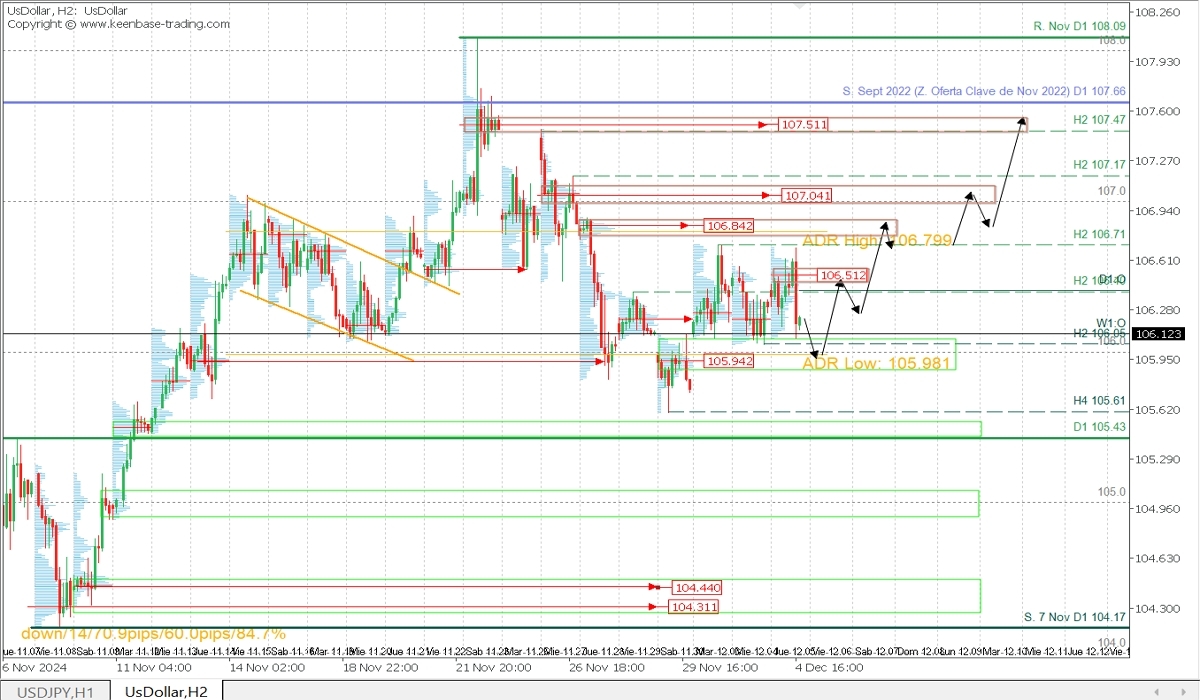

Dollar Index (DXY), H2

- Supply Zones (Sell Areas): 106.84, 107.04, and 107.51

- Demand Zones (Buy Areas): 106.50 and 105.94

After weaker-than-expected ISM Non-Manufacturing PMI data, the USD price declined toward the weekly open at 106.12, a local demand zone forming support alongside 106.00, the lower range at 105.98, and the uncovered POC at 105.94. This level could halt further price decline and potentially renew buying interest toward 106.51 and the next supply zone between 106.80 and 106.84.

Upside continuation in the coming days will depend on the price's reaction to the supply zones and its ability to break through these levels, potentially extending bullish momentum toward and above 107.00 this week. However, a decisive break below the demand zone between 106.05 and 105.94 would threaten the 105.61 support, whose breach would reverse the bullish outlook and extend the broader macro correction toward 105.43.

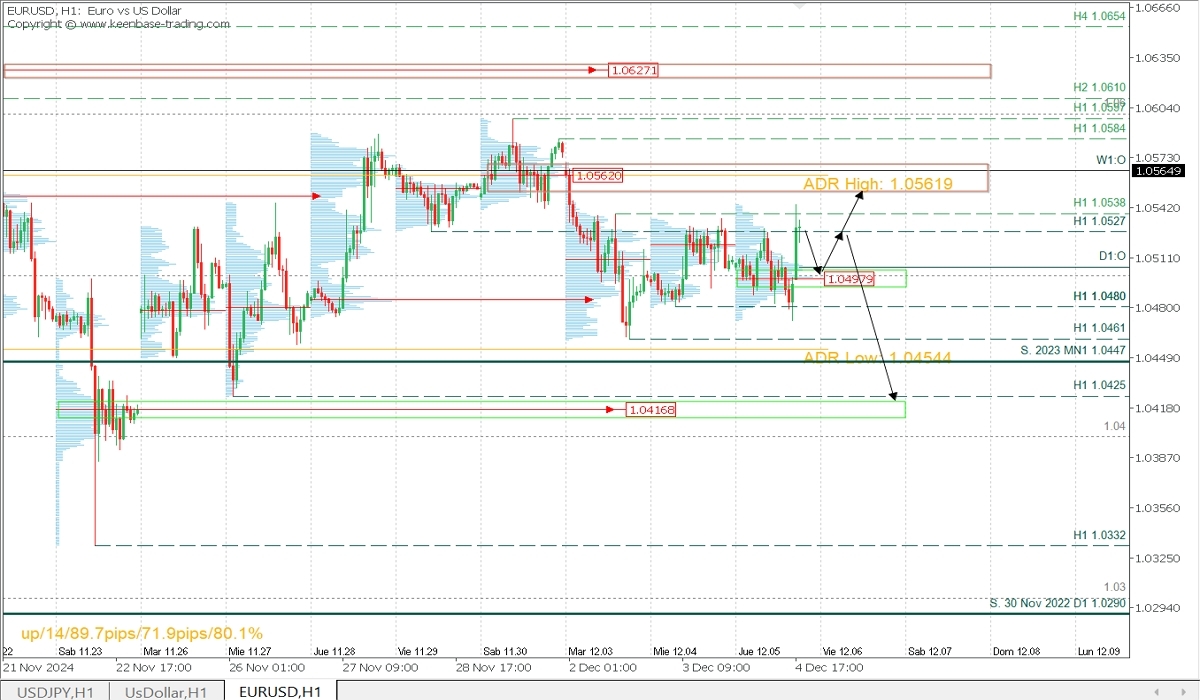

EURUSD, H1

- Supply Zones (Sell Areas): 1.0562

- Demand Zones (Buy Areas): 1.0497 and 1.0416

The mild breakout above the 1.0538 resistance may trigger new buying interest targeting higher liquidity in the supply zone around 1.0562, particularly after a pullback toward today’s buying POC at 1.0497. This could spark an intraday bullish reversal aiming for 1.06 and 1.0627 in the coming days.

However, if bears overpower bulls around 1.0497 during the retracement, further selling pressure could drive the pair toward supports at 1.0461, 1.0447, and 1.0425, signalling a continuation of the downtrend.

Technical Summary

- Bearish Scenario: Sell below 1.0527 with TPs at 1.05 and 1.0497; after a decisive break, consider targets at 1.0471 and 1.0461 intraday, with 1.0425 and 1.0417 as longer-term objectives.

- Bullish Scenario: Buy after breaking above 1.05 (if a PAR* forms and confirms on M5) with TPs at 1.0538, 1.0562 intraday, and 1.0584, 1.06, and 1.0627 in the coming days. Use an SL of 1% of your capital and lower lot sizes to allow room for market movement.

Always wait for the formation and confirmation of a Pattern of Exhaustion/Reversal (PAR) on M5, as taught here https://t.me/spanishfbs/2258, before entering trades in the indicated key zones.

Uncovered POC:

- POC = Point of Control: This is the price level or zone where the highest concentration of volume occurred. If a bearish move originated from this level, it is considered a sell zone, forming a resistance area. Conversely, if a bullish impulse originated, it is regarded as a buy zone, often found near lows, thus forming support areas.