Fundamental Analysis

Recent Context for the S&P 500

The S&P 500 has recorded sharp declines in recent days despite generally positive corporate and macroeconomic news. Volatility has risen, and the bearish pressure has been amplified by both technical and sector-specific factors.

NVIDIA Surprised, but the Market Didn’t Follow

NVIDIA Corporation posted record growth and raised its forward guidance, yet the index dropped. Weakness spread through the semiconductor sector, weighing on Advanced Micro Devices and Micron Technology, triggering broad selling across technology and dragging the rest of the market lower.

Labour Data and a Contradictory Logic

The latest NFP report showed stronger-than-expected job creation. In theory, this should have eased pressure on the Federal Reserve and supported the market, but the opposite occurred: selling intensified. Managers interpreted that rate cuts would be delayed, and once key technical levels broke, automated liquidations accelerated the fall.

The Weight of the “Magnificent 7” and the Amplifier Effect

The “Magnificent 7”—NVIDIA Corporation, Apple Inc., Microsoft Corporation, Amazon.com Inc., Alphabet Inc., Meta Platforms, and Tesla Inc.—represent nearly 37% of the S&P 500. This concentration means that any sectorwide retreat hits the entire index with disproportionate force.

Technical Analysis

US500 — Daily Chart

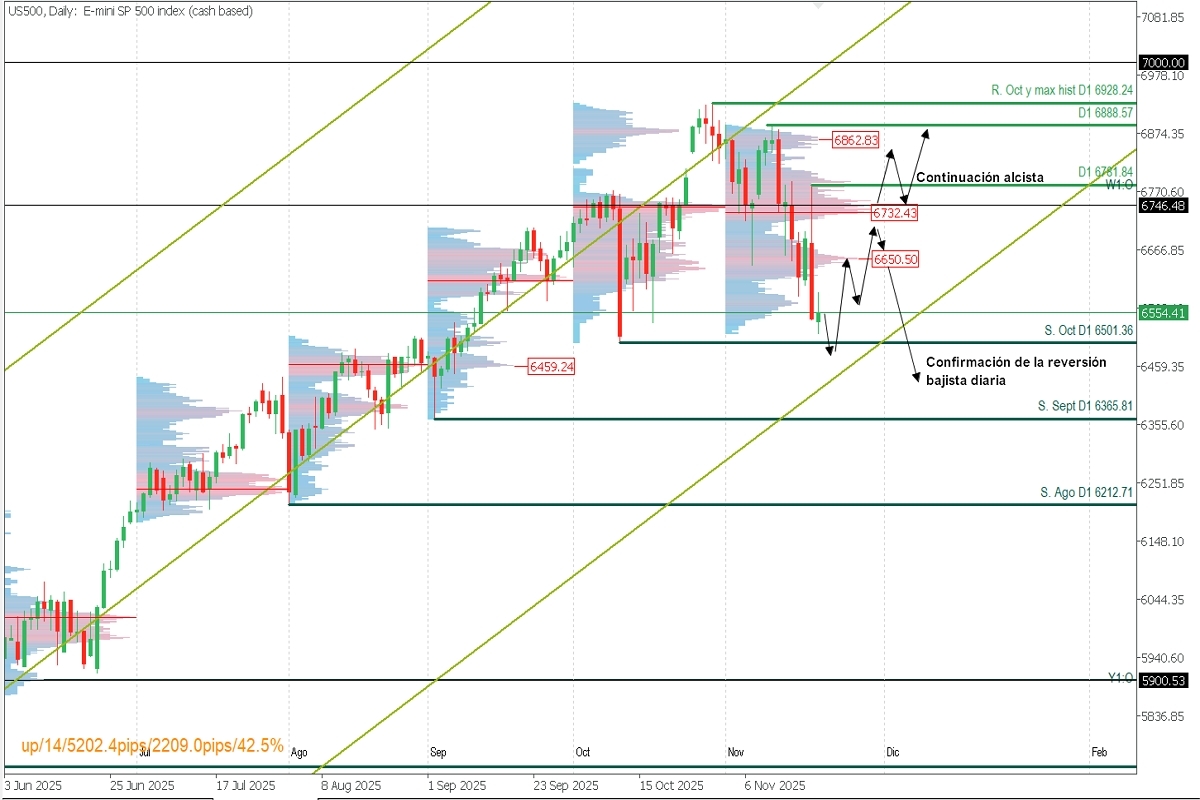

The macro uptrend remains intact, although the most recent decline has brought the index back to October lows, touching the lower boundary of the upward linear regression channel drawn from this year’s lows.

As long as the price does not decisively break (two confirmed downward breaks) the last validated daily support from October at 6501.36, the bullish trend could attempt to resume.

However, the correction is forming a monthly volume concentration (POC) almost identical to October’s, which often signals a reversal pattern. In this context, any recovery must break above the selling volume node around 6650.50, then clear the monthly POC (three-week cluster) near 6732.43, and finally the last corrective resistance at 6781.84.

On the other hand, if price fails to break decisively above the monthly POC at 6732.43, another downward move toward 6500 becomes more likely, implying a daily bearish reversal.