Fundamental Analysis

The USD remains strong amid escalating geopolitical tensions and expectations of a hawkish stance from the Federal Reserve (Fed). Ukraine’s recent strike on Russian territory using U.S.-supplied ATACMS missiles has heightened tensions in Eastern Europe, driving demand for safe-haven assets like the dollar. Additionally, Russia’s expanded nuclear doctrine further exacerbates risk aversion in global markets.

Regarding the EURUSD, the pair struggles to hold above 1.0500, maintaining a predominantly bearish bias. The reduced likelihood of a rate cut by the Fed in December, now at 62% according to the CME FedWatch Tool, highlights the divergence between U.S. and European monetary policies. While the dollar benefits from a backdrop of high inflation and resilient U.S. growth, the euro faces pressure from weaker economic activity in the Eurozone and a less aggressive ECB stance.

This week, the spotlight will be on the preliminary November PMI data. Expectations are for improved private sector activity in the U.S., which could further bolster the dollar’s position against major counterparts. Geopolitical tensions and signs of U.S. economic strength solidify a bearish outlook for EURUSD in the short term.

Technical Analysis

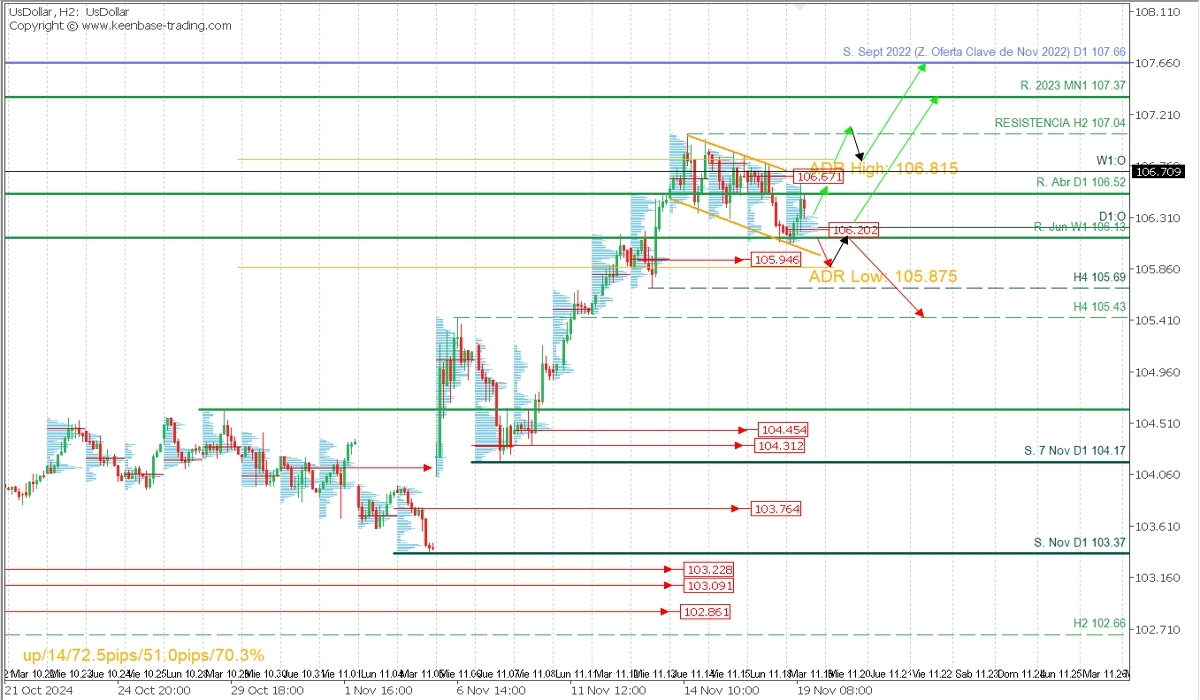

Dollar Index (DXY), H2

- Bid Zones (Sellers): 106.67, 107.66, and 108.00

- Ask Zones (Buyers): 106.20, 105.94, and 105.43

The dollar index is correcting within a narrow bearish channel after recent weeks' rally. Currently trading within a supply and demand range between 106.67 and 106.19, the outlook is bullish as long as buyers push through the supply zone between 106.67 and the daily bullish range at 106.81. This move could open the door for further upward momentum toward resistance at 107.04, the 2023 high at 107.37, and the November 2022 supply zone between 107.66 and 108.00. This scenario holds as long as the price stays above the demand zones and the validated intraday support is at 105.69. A breakdown below these levels could signal the start of a bearish reversal and macro-corrective phase.

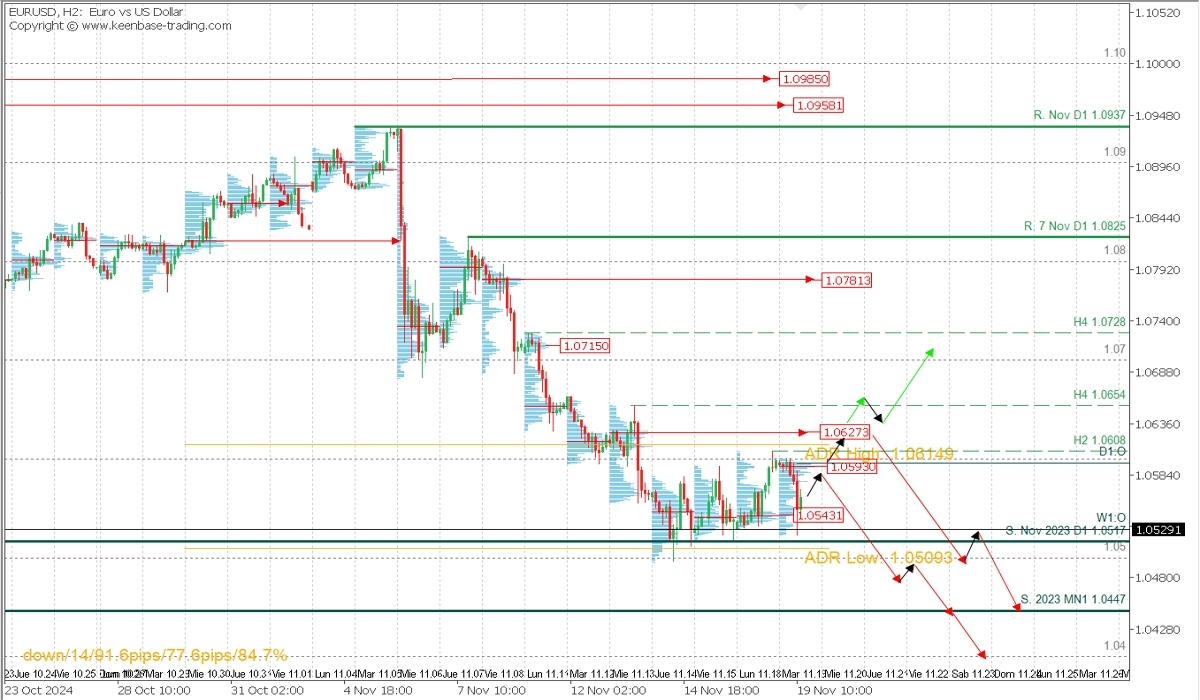

EURUSD, H2

- Bid Zones (Sellers): 1.0593 Y 1.0627

- Ask Zones (Buyers):1.0543 y 1.0445

Under the above scenario, the pair is expected to renew selling pressure if it stays below the supply zone between 1.0593 and 1.0627, with buying targets at the psychological level of 1.05, the 2023 support at 1.0447, and the next psychological round number at 1.04.

This outlook remains valid if the price does not break above the mentioned supply zone and the validated intraday resistance at 1.0654. A breakout above this level would initiate a macro-bullish corrective phase.

Technical Summary

Anticipated Bearish Scenario: Short below 1.0593 and 1.0540 with take profit (TP) at 1.05, 1.0450, and 1.04 in extension. Use a 1% stop loss (SL) of your capital with a low lot size to allow for price movement.

Invalidation:

The bearish scenario is invalidated if the price breaks above 1.0630/1.0654.

Always wait for the formation and confirmation of an Exhaustion/Reversal Pattern (PAR) on M5 as outlined here: before entering any trades in the key zones indicated.

Naked POC (Point of Control):

The Point of Control (POC) is the level or zone where the highest volume concentration occurred. If a bearish movement follows it, it is considered a sell zone and forms resistance. Conversely, if it precedes a bullish impulse, it is viewed as a buy zone, usually located at lows and forming support zones.