The NZDUSD pair held steady above 0.5900 during Friday's European session, supported by a weaker US dollar (USD). The US Dollar Index (DXY) has dropped below the critical 106.00 level, hitting a two-week low near 105.60 before recovering slightly. The USD's weakness comes as investors adjust their positions following President-elect Donald Trump's nomination of Scott Bessent as Treasury Secretary, who is expected to implement trade policies cautiously to avoid significant disruptions.

Looking ahead, traders are waiting for critical US employment data and PMI figures for November, which will be released next week. These reports will shape expectations for the Federal Reserve's (Fed) next move in December, with markets currently pricing a 66% chance of a 25 basis point interest rate cut.

Meanwhile, the New Zealand Dollar (NZD) remains strong despite the Reserve Bank of New Zealand (RBNZ) cutting interest rates by 50 basis points to 4.25% earlier this week. RBNZ Governor Adrian Orr suggested further cuts might be possible in February, depending on how the economy performs, though he noted signs of easing inflation pressures. The Kiwi continues to show resilience in the face of these developments.

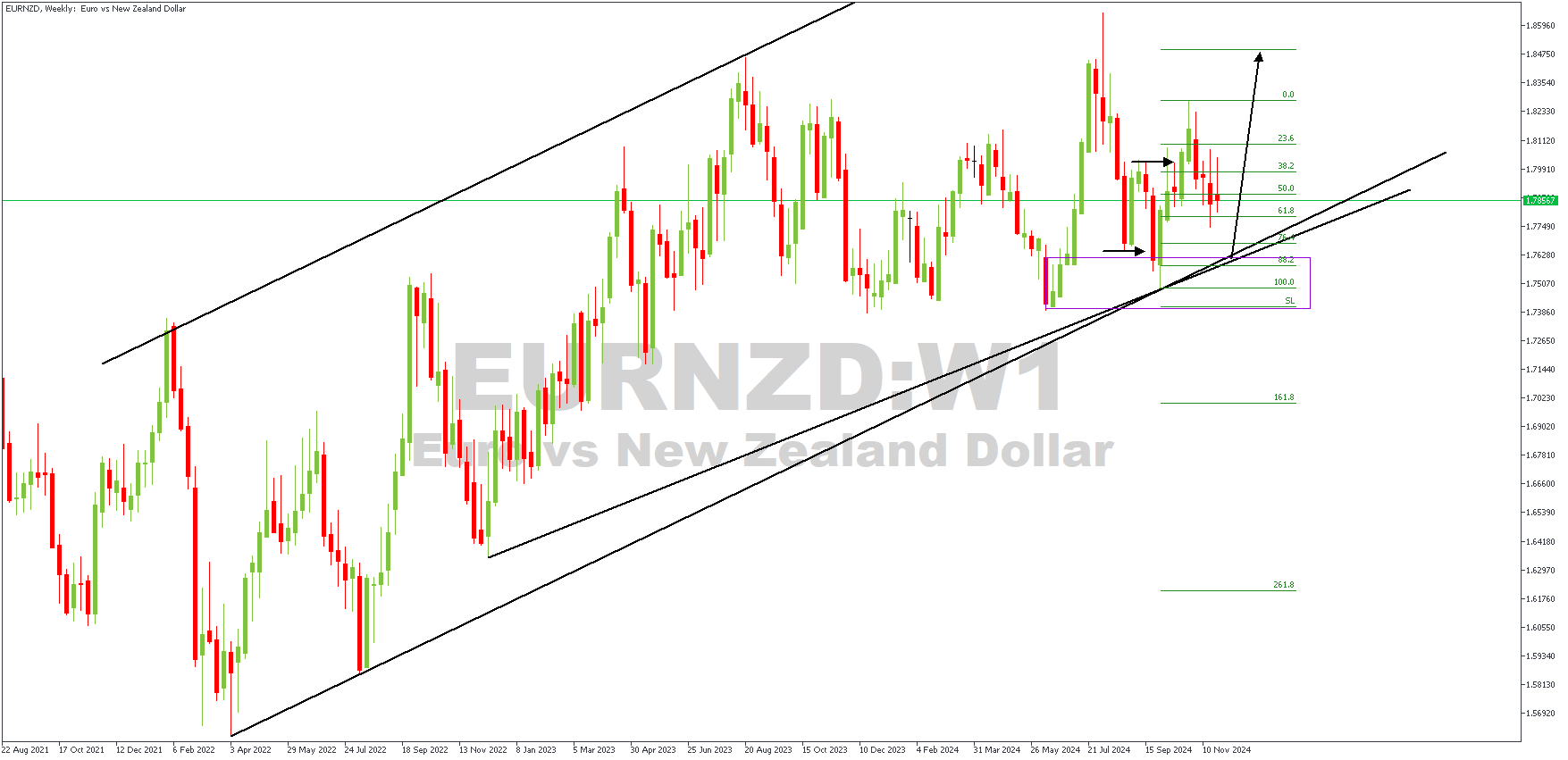

EURNZD – W1 Timeframe

The weekly timeframe chart of EURNZD can be seen trading within a rising channel with the price action sliding towards the trendline support. The trendline enjoys further confluence from the demand zone and the 88% Fibonacci retracement level. Now, let's see how things look on the daily timeframe chart.

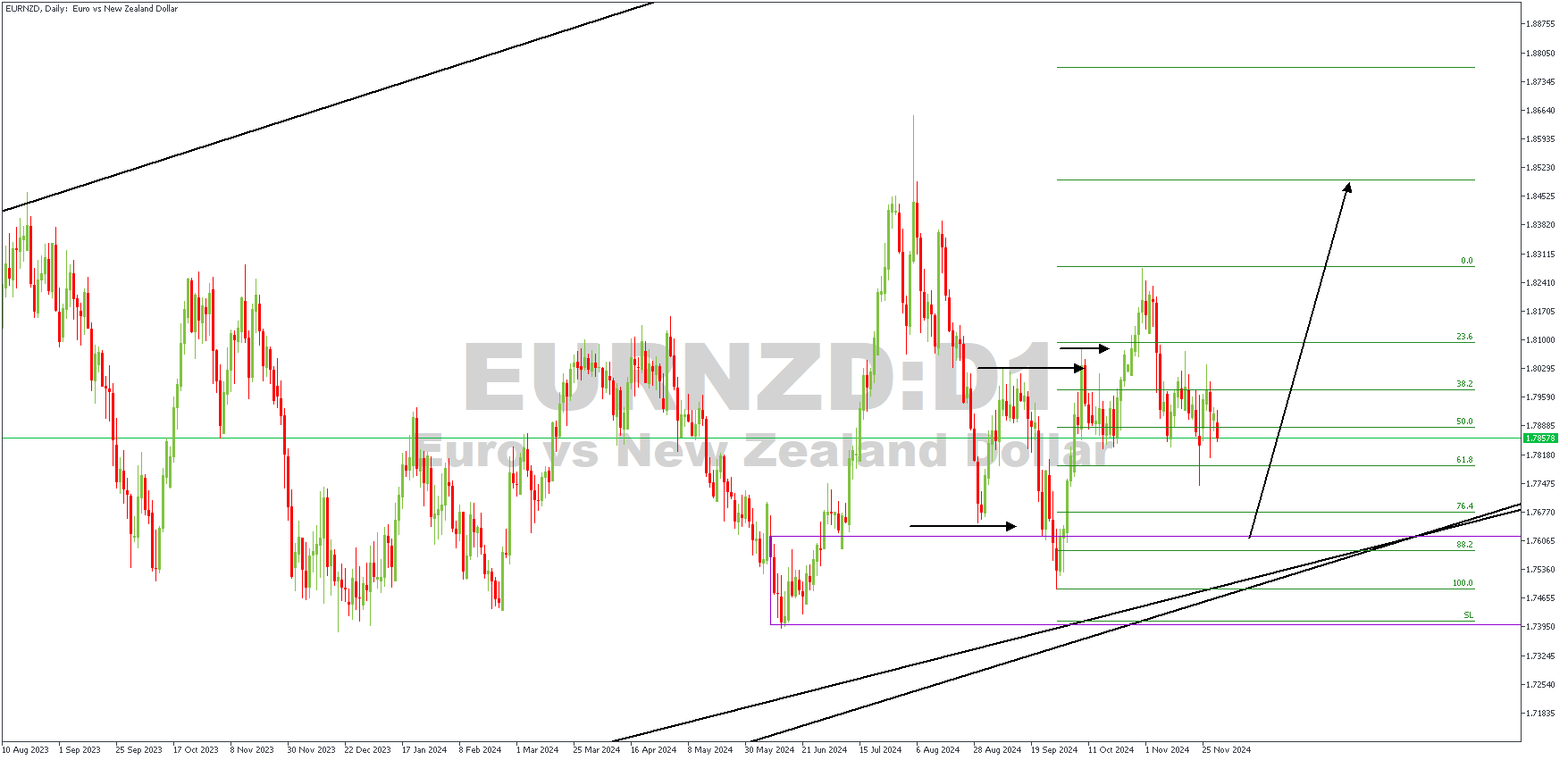

D1 Timeframe

The price action on EURNZD's daily timeframe shows the familiar appearance of a double break of structure pattern, with the demand zone in sync with the 88% Fibonacci retracement level. The entry area enjoys additional support from the confluence of the two trendlines just beneath the demand zone, thus increasing the likelihood of a bullish outcome.

Analyst's Expectations:

Direction: Bullish

Target: 1.82820

Invalidation: 1.74693

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.